The trigger? A dismal August jobs report. The U.S. added just 22,000 jobs — a faceplant compared to the 75,000 expected. That weak data was enough for analysts to flip their playbooks.

Bank of America: once staunchly against cuts, now calls for two 25-basis-point trims — September and December. Goldman Sachs: even more aggressive, betting on three cuts in September, October, and November. Citigroup: ditto, expecting 75 basis points shaved off in three equal steps.If you’re keeping score: that’s a near-unanimous pivot from the “no cuts” narrative to “multiple cuts incoming.”

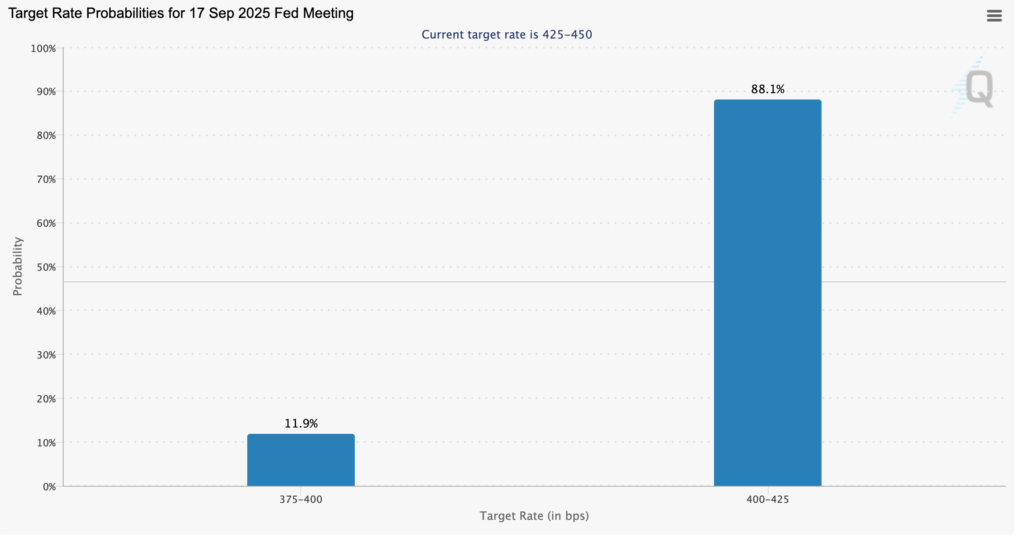

The probability of rate cuts, Source: CME

Why It Matters for Crypto

When rates fall, money gets cheaper, credit flows, and investors suddenly remember they like risk. That’s when speculative assets — Bitcoin, Ethereum, Solana, take your pick — start running. Rate cuts in 2025 could mark the beginning of the next liquidity wave, the kind of macro backdrop that historically sends crypto into bull mode.

The Chicago Mercantile Exchange’s FedWatch tool shows traders already pricing this in: 88% expect a 25bps cut at the September FOMC meeting, and about 12% are calling for 50bps. That’s basically consensus.

The Fed’s Dilemma

Powell himself teased the possibility during his Jackson Hole speech in late August. The Fed’s twin mandate — jobs and inflation — is being squeezed from both ends. Inflation is cooling, but job growth is wobbling hard. With the labor market cracking, “maximum employment” is under threat, and the Fed may have no choice but to cut to keep the wheels from coming off.

For crypto traders, rate cuts are bullish by design. Liquidity sloshes around, and risk assets — the ones that benefit most when money is cheap — get the biggest tailwind. The Fed may still posture like it’s in control, but the market has already decided: 2025 is shaping up to be risk-on.

3 months ago

60

3 months ago

60

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·