TLDRs;

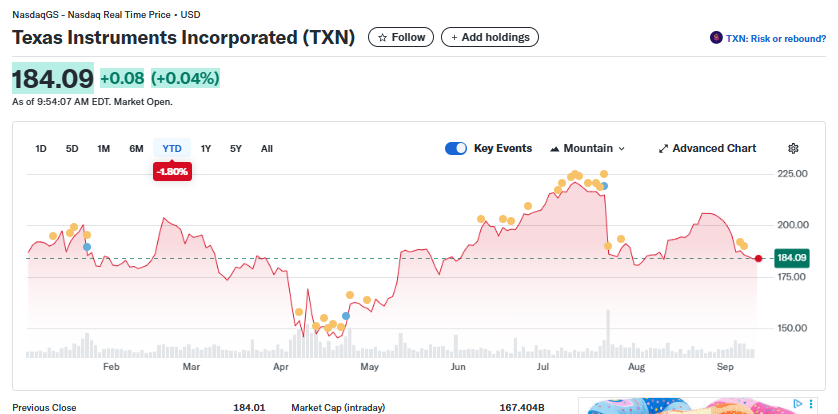

Texas Instruments’ data center revenue grows over 50% in 2025, countering stock’s 1.8% YTD decline. CEO Haviv Ilan anticipates data center segment could reach 20% of total sales soon. TI plans $60B US investment to expand chip production amid rising AI demand. Growing data center power needs boost analog semiconductor opportunities for TI.Texas Instruments (TXN) is signaling a strong recovery in one of its fastest-growing segments despite the company’s stock being down 1.80% year-to-date.

CEO Haviv Ilan recently highlighted that the company’s data center business has expanded at a pace exceeding 50% in 2025, making it the standout performer in Texas Instruments’ diverse semiconductor portfolio.

Speaking at a Goldman Sachs technology conference, Ilan described the data center market as the company’s most dynamic segment this year.

“While data center revenue currently represents a small portion of our total sales, we expect it to reach 20% in the foreseeable future,” Ilan said, pointing to the segment’s massive growth potential.

Currently, Texas Instruments’ total annual revenue stands at $16.68 billion, meaning data center sales could eventually surpass $3.3 billion.

Texas Instruments Incorporated (TXN)

Texas Instruments Incorporated (TXN)

AI-Driven Data Centers Fuel Demand

The surge in data center revenue is closely tied to the rapid expansion of AI infrastructure. As companies build AI-optimized facilities, demand for high-performance semiconductors, particularly analog devices that manage power and data flow, has accelerated.

The International Energy Agency projects that electricity consumption from data centers could double by 2026, driven primarily by AI applications. By 2030, data centers may account for up to 21% of global energy demand, creating sustained opportunities for Texas Instruments’ analog and power management solutions.

“This trend directly benefits our core technology,” Ilan noted.

Analog semiconductors are critical for managing power efficiency and high-speed data transmission, both essential as data centers pack more AI processing units into tighter spaces.

Massive Domestic Investment in Chip Production

In June 2025, Texas Instruments announced a landmark $60 billion investment to expand semiconductor manufacturing across the United States.

The initiative will establish seven fabrication plants in Texas and Utah, creating over 60,000 jobs and further solidifying the company’s position in a global semiconductor market dominated by US-China competition.

US Commerce Secretary Howard Lutnick lauded the initiative as vital for national semiconductor strength, emphasizing that TI’s move aligns with broader governmental efforts to onshore critical chip production. The expansion is expected to support key sectors, including data centers, smartphones, and automotive electronics, while ensuring the US maintains leadership in advanced semiconductor technology.

Strong Segment Counters YTD Drop

Despite the year-to-date 1.8% decline in TXN shares, analysts view the company’s data center growth and US investment as promising indicators of long-term performance. Recent quarterly revenue already shows momentum, with a 16.38% increase compared to the prior quarter, suggesting that the recovery Ilan described is underway.

Industry watchers note that as the data converter market grows, expected to increase from $5.5 billion in 2023 to $7.4 billion by 2028, Texas Instruments is well-positioned to capture a significant portion of that growth, potentially reshaping the company’s revenue mix over the next several years.

With AI-driven demand surging and strategic domestic investments underway, Texas Instruments is navigating its current stock performance challenges while laying the groundwork for robust long-term growth.

The post Texas Instruments (TXN) Stock: Data Center Expansion Boosts Outlook Despite YTD Loss appeared first on CoinCentral.

5 hours ago

2

5 hours ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·