Key Points

Borrowers on the Saving on a Valuable Education (SAVE) plan continue to not have to make payments on their student loans. The Department of Education has begun extending their administrative forbearance into early 2026, signaling once again that repayment will not resume this year.

The extensions, which have been issued in three-month intervals, are keeping SAVE plan borrowers from having to make payments until the Department of Education transitions the roughly 7 to 8 million SAVE borrowers into IBR.

Under the recently enacted “One Big Beautiful Bill Act,” SAVE is permanently eliminated, and borrowers will eventually move into IBR or have the option to enroll in the new Repayment Assistance Plan (RAP), which becomes available in July 2026.

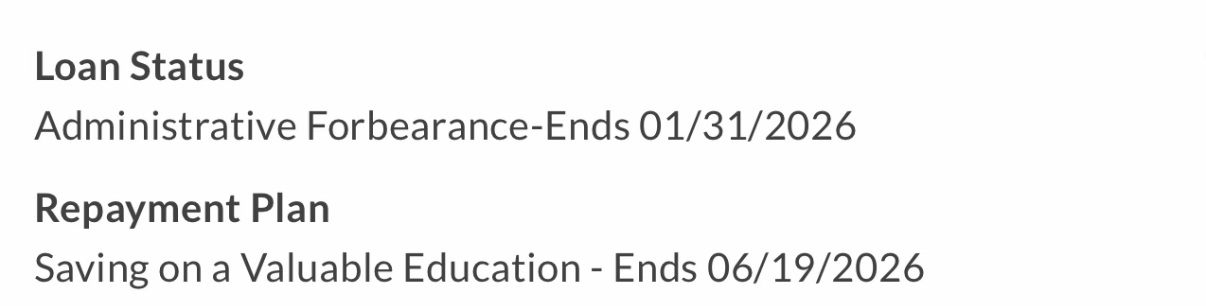

Our most likely timeline estimate for the end of SAVE have always been a July 2026 transition date, and based on what borrowers are reporting in their loan portals, this seems likely. For example, this borrower screenshot shows a SAVE end date of 6/19/2026. This would align with migrations to IBR starting in July 2026 and payments resuming at that time.

Would you like to save this?

Why The SAVE Forbearance Keeps Extending

The repeated extensions are not accidental. The SAVE plan was permanently blocked by the courts, with the 8th Circuit Court of Appeals officially preventing loan servicers from resuming payments under the plan. Since payments cannot resume under SAVE, the Department of Education has been trying to figure out what to do with the 7 to 8 million borrowers in the plan.

Congress solved the problem - it officially eliminated SAVE and directed borrowers enrolled in SAVE to be moved to IBR. But the timeline was left semi-open: it has to happen before June 30, 2028, though it can happen sooner. And we have been expecting it sooner: likely July 2026.

Every three months, the department effectively buys more time to align borrower communications, servicer technology, and regulatory rulemaking with the deadlines set in law. The next court update in October 2025 may provide additional clarity, though the department is not expected to force borrowers into IBR before the new plans are available - which now seems even more likely given the date extensions.

For borrowers, that means continued waiting - which could be a blessing or a curse. It's a blessing for those unable to resume student loan payments due to budget concerns. But it can be a curse for those looking for loan forgiveness - as the SAVE forbearance does not directly count for PSLF, and does not count for long term loan forgiveness.

What SAVE Borrowers Should Expect

The SAVE forbearance has been unique: while interest will has resumed as of August 2025, no monthly payments are due until borrowers are placed into a replacement plan (which will be IBR). This unusual setup has caused widespread confusion, but the department is limited in its options because courts barred SAVE from continuing.

There now appear to be two plausible repayment scenarios:

Mid-2026 Migration: The most probable option is to keep borrowers in forbearance until July 2026, when IBR and RAP are officially implemented. This would allow for a coordinated transition with fewer disruptions. And it appears likely with the latest "SAVE end date" posted in borrower accounts.Wildcard Timelines: The law requires SAVE, PAYE, and ICR to end by June 2028, but keeping borrowers in forbearance that long would create major operational challenges for loan servicers.At present, the department is signaling that mid-2026 is the most realistic restart date.

What Happens Next

While borrowers cannot control the timeline, they can prepare for the eventual transition. Borrowers at least have clarity on the specific student loan repayment plans available to them.

While waiting, borrowers should monitor current loan balances, reviewing eligibility for Public Service Loan Forgiveness, and understanding how IBR and RAP payments could impact them. Use a student loan calculator to assess the options.

Borrowers should also be aware of how the buyback of past forbearance months might work or if it's better to begin repayment, particularly for those nearing forgiveness timelines. With processing backlogs still lingering, timely recordkeeping will be important.

Don't Miss These Other Stories:

Editor: Colin Graves

The post SAVE Borrowers’ Forbearance Extended Into 2026 appeared first on The College Investor.

3 months ago

31

3 months ago

31

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·