TLDR

MARA Holdings increased its bitcoin treasury to 52,477 BTC worth $5.9 billion, making it the second-largest public bitcoin holder after MicroStrategy The company mined 705 BTC in August despite bitcoin’s 6.5% price decline during the month MARA maintains its “full HODL” strategy, retaining all mined bitcoin and making strategic acquisitions during price dips The firm’s hashrate grew to 59.4 EH/s with its Texas wind farm now fully operational MARA agreed to acquire a 64% stake in French energy company EDF’s subsidiary Exaion, expanding into European marketsMARA Holdings has pushed its bitcoin treasury to new heights, reaching 52,477 BTC valued at $5.9 billion according to its August production update. The achievement solidifies the company’s position as the second-largest public bitcoin holder, trailing only Michael Saylor’s MicroStrategy.

Nearly 1 in every 20 $BTC that will ever exist is now held by listed firms.

Public companies now control over 1M $BTC, that’s 5.1% of Bitcoin’s total supply.

Microstrategy is leading with 636,505 $BTC, followed by MARA (52,477 BTC) and Metaplanet. pic.twitter.com/PwZzJGurCW

— Lucky (@LLuciano_BTC) September 6, 2025

The mining giant produced 705 BTC worth $79.2 million in August, slightly exceeding July’s output of 703 BTC. This represents a 4.9% share of all bitcoin miner rewards during the period, including transaction fees.

August proved challenging for the cryptocurrency market. Bitcoin reached an all-time high of around $124,500 on August 14 before closing the month 6.5% lower.

The digital asset dropped as much as 13.7% from its peak to around $107,500. Bitcoin currently trades at $112,434, showing a 1.4% gain over the past 24 hours.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

MARA’s leadership viewed the price decline as an opportunity rather than a setback. “Given the decline in bitcoin price during the month, we took the opportunity to strategically add to our treasury,” CEO Fred Thiel stated.

The company captured 208 blocks in August as global hashrate increased 6% month-over-month to an average of 949 EH/s. MARA’s own energized hashrate grew 1% to 59.4 EH/s during the same period.

Mining Infrastructure Expansion

The Texas wind farm represents a key component of MARA’s operations, with all containers now fully operational. The facility aligns with the company’s focus on renewable energy-powered mining operations.

MARA joins an exclusive group of public operators controlling more than 50 EH/s. Other members include IREN, CleanSpark, and Cango as bitcoin’s network hashrate recently surpassed the one zetahash per second milestone.

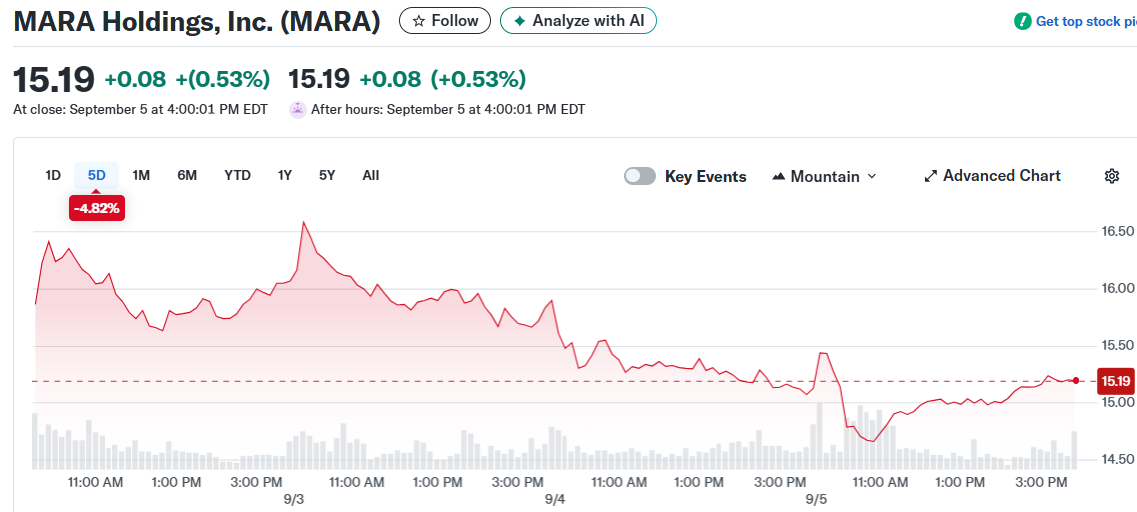

Despite operational success, MARA’s stock performance has faced headwinds. The share price fell 4.9% over the past month and remains down 13.5% year-to-date.

MARA Holdings, Inc. (MARA)

MARA Holdings, Inc. (MARA)

The company recently lost its status as the largest public mining firm by market capitalization to IREN. IREN’s stock surged 59.4% during the past month following strong quarterly earnings, boosting its year-to-date gain to 153.4%.

IREN currently maintains a market cap of around $7.7 billion compared to MARA’s $6.1 billion. Riot Platforms holds third place with a $4.3 billion valuation.

European Expansion Strategy

MARA agreed to acquire a 64% stake in EDF subsidiary Exaion during August, with an option to increase ownership to 75% by 2027. The deal is expected to close in late 2025.

The venture aims to combine MARA’s technology stack with artificial intelligence to reduce costs and strengthen edge infrastructure. The company also opened its European headquarters in Paris to drive international growth.

“Together, these announcements reinforce MARA’s role in advancing energy partnerships dedicated to stabilizing power grids while capturing and repurposing unused energy,” Thiel explained.

MARA implemented its “full HODL” strategy in July 2024, retaining all mined bitcoin rather than selling for operational expenses. The approach reflects management’s confidence in bitcoin’s long-term value proposition.

“We believe bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it,” Thiel said when announcing the policy change.

The company uses existing cash reserves and capital markets to fund operations instead of selling newly mined bitcoin. In December, MARA announced a proposed $700 million zero-coupon convertible senior notes offering to acquire additional bitcoin beyond mining production.

MicroStrategy maintains its position as the largest public bitcoin holder with 636,505 BTC worth $72 billion. The company announced another $449.3 million bitcoin acquisition on Tuesday, further expanding its substantial treasury.

The post MARA Holdings (MARA) Stock: Mining Giant’s Bitcoin Reserves Surge To $5.9 Billion appeared first on CoinCentral.

3 months ago

44

3 months ago

44

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·