TLDRs;

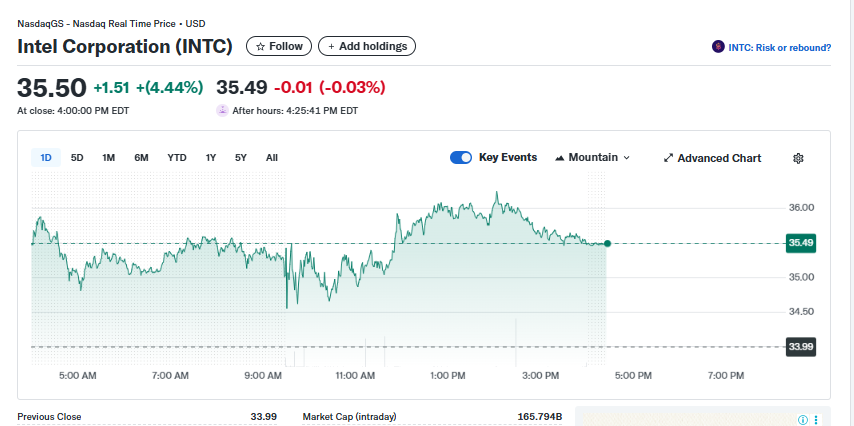

Intel (INTC) stock surged nearly 5% after reports of talks with TSMC for AI chip manufacturing partnerships. The chipmaker has faced struggles competing with Nvidia and AMD in the booming AI sector. Nvidia and SoftBank have recently invested billions into Intel, boosting investor sentiment despite ongoing challenges. Analysts caution Intel still needs foundry customers and execution, not just capital, to sustain its recovery.Intel Corporation (NasdaqGS: INTC) surged 4.44% on Friday after reports suggested the chipmaker had approached Taiwan Semiconductor Manufacturing Company (TSMC) to explore potential investments or manufacturing collaborations.

The development, highlighted by sources familiar with the matter, has sparked optimism that Intel could strengthen its competitive standing in the artificial intelligence chip market.

Intel Corporation (INTC)

Intel Corporation (INTC)

A Company Fighting for Relevance

Once synonymous with Silicon Valley’s innovation, Intel has been struggling to regain its dominance in the semiconductor industry. The rise of Nvidia and AMD in AI acceleration has left Intel scrambling to secure its place in the new era of chipmaking.

Despite billions invested in its foundry operations, Intel’s efforts to compete with TSMC’s highly advanced manufacturing capabilities have largely failed to attract meaningful external customers.

The potential tie-up with TSMC could represent a turning point. Reports suggest preliminary talks may include both a direct investment and possible joint ventures, with speculation around TSMC taking as much as a 20% stake in a new Intel entity. Neither Intel nor TSMC commented on the discussions.

Investor Excitement Meets Analyst Caution

Wall Street welcomed the news, pushing Intel shares higher by almost 5%. The stock is now trading nearly 90% above its August low, buoyed not only by the TSMC talks but also by recent high-profile investments.

Nvidia recently committed $5 billion for a roughly 4% stake in Intel, while SoftBank injected $2 billion in capital last month. Reports of Apple exploring a strategic investment have further fueled momentum.

Yet, despite the surge, analysts remain cautious. Options pricing indicates Intel shares could swing significantly in the coming months, with December contracts forecasting a range between $26.77 and $39.69. The consensus Wall Street rating still sits at “Hold,” with a median price target near $25, signaling possible downside of about 25% from current levels.

The Road Ahead for Intel

While the market is encouraged by the influx of capital and potential strategic partners, skeptics argue that Intel’s challenges go beyond funding. The company’s foundry division, critical to its turnaround, has yet to prove it can deliver advanced nodes at the scale of TSMC or Samsung.

Even if Apple or TSMC were to invest, analysts warn the deals may prove more symbolic than transformative unless Intel secures major long-term customers for its manufacturing business. For now, investor enthusiasm hinges on Intel’s ability to convert partnerships into tangible progress in AI chip production.

Still, the market’s reaction suggests hope. With AI demand surging worldwide, Intel’s attempt to court TSMC signals it is willing to forge unconventional alliances to stay relevant. Whether that is enough to spark a full revival remains to be seen.

The post Intel (INTC) Stock: Surges Almost 5% on Talks with TSMC for AI Chips appeared first on CoinCentral.

2 months ago

74

2 months ago

74

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·