Hyperliquid price hovers near a key breakout zone. After weeks of choppy action between $42 and $48, analysts now argue that the HYPE coin could be setting up for its next big move.

Hyperliquid Price Volatility & Long-Term Trend

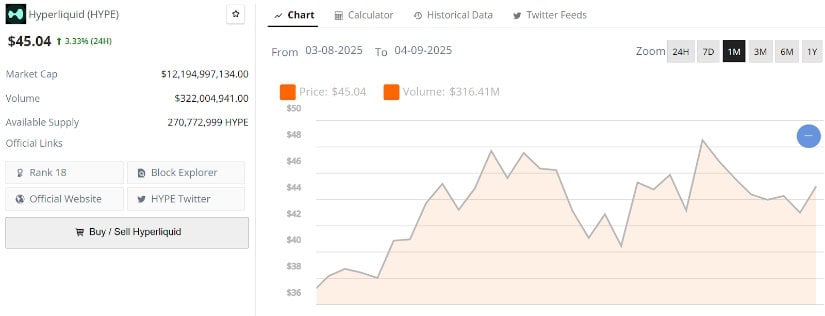

Hyperliquid is currently priced at $45.04, posting a modest +3.33% gain over the past 24 hours. Looking at the 1-month chart, the token has been fluctuating between $42 and $48, reflecting short-term volatility within a broader sideways structure. The $44 region has been tested multiple times as support, while sellers continue to step in closer to the $47 to $48 range.

From a technical standpoint, HYPE’s structure still leans constructive in the long run. The $40 level remains a key higher-timeframe support, which, if defended, keeps the broader uptrend intact. On the upside, a clean breakout above $48 could open the door towards retesting $50 and targeting beyond $60 levels.

Hyperliquid’s current price is $45.04, up 3.33% in the last 24 hours. Source: Brave New Coin

With a market cap of $12.1B and daily volume over $322M, liquidity remains strong, giving Hyperliquid the foundation to sustain its trend as long as buyers continue to defend these critical levels.

August Revenue Jump Adds Confidence to HYPE

Hyperliquid just closed August with record-breaking revenue, surpassing $100 million, a 23% jump from July. This performance was powered by nearly $400 billion in perpetual trading volume, reinforcing its growing dominance in the derivatives space. The accompanying market share chart highlights how HYPE has steadily eaten into competitors’ positions, reflecting sustained growth and user confidence.

Hyperliquid’s August revenue surged past $100M, marking a 23% monthly jump fueled by $400B in trading volume. Source: Milk Road via X

From a market perspective, such strong fundamentals provide a supportive backdrop for Hyperliquid’s price structure. While recent trading has hovered between $42 and $48, the steady revenue climb suggests underlying demand remains intact. If momentum continues, these fundamentals could help push HYPE beyond the current resistance band and lay the groundwork for a longer-term trend higher, keeping the $50–$60 range in focus.

Hyperliquid Technical Analysis

Following its ongoing volatile consolidation phase, the $44 to $45 zone acts as a key pivot. The chart shared by UB highlights how repeated retests of support have been absorbed, creating a base for potential continuation. Price is currently consolidating just below $45.50, a level that now stands out as the immediate resistance bulls need to clear. Holding this region on lower-timeframe retests strengthens the case that momentum could shift back toward the upper range.

Hyperliquid consolidates near $45.50, with bulls eyeing a breakout towards the $49–$50 resistance zone. Source: UB via X

If buyers manage to sustain strength above $45.50, it would signal a clean breakout from the current consolidation. That opens the door for a move back towards $49 to $50, a zone that previously capped upside attempts. With fundamentals also showing consistent growth in revenue and trading activity, this technical setup aligns with a constructive Hyperliquid outlook.

Contrary View: Bulls Must Clear $50 to Avoid Losing Momentum

Following the bullish takes on HYPE, not all analysts agree on the immediate path forward. While HYPE coin has held firm around the $42 to $40 zone, Polaris

points to a developing risk: higher-timeframe bearish divergences. These divergences show momentum indicators trending lower even as price remains stable, hinting that upside attempts are losing strength. A failure to convincingly clear the $50 level could give sellers the upper hand.

Hyperliquid faces bearish divergence risks, with failure to break $50 potentially dragging price towards the $30–$35 FVG zone. Source: Polaris via X

If that plays out, the downside risk shifts towards the monthly Fair Value Gap (FVG) in the $30 to $35 region. Unless momentum recovers quickly, this divergence pattern suggests buyers may need to tread carefully in the short term. While Hyperliquid’s fundamentals remain supportive, the chart setup signals a mixed outlook.

Final Thoughts

Hyperliquid sits at an interesting make-or-break spot. On one hand, strong August revenue growth, solid liquidity, and consistent support retests show that fundamentals continue to back the uptrend.

Bull Targets: Breakout above $45.50, confirmation through $48, with upside potential towards $50 to $60.

Bear Targets: Failure to clear $50 could trigger downside toward the $30 to $35 Fair Value Gap zone.

For now, market watchers will be closely observing whether buyers can build momentum past immediate resistance or whether bearish divergences play out and shift control back to sellers.

2 hours ago

2

2 hours ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·