Despite Hayes’ exit and rising pressure from ASTER, Hyperliquid has managed to hold its ground near key demand levels, showing that buyers aren’t ready to give up just yet.

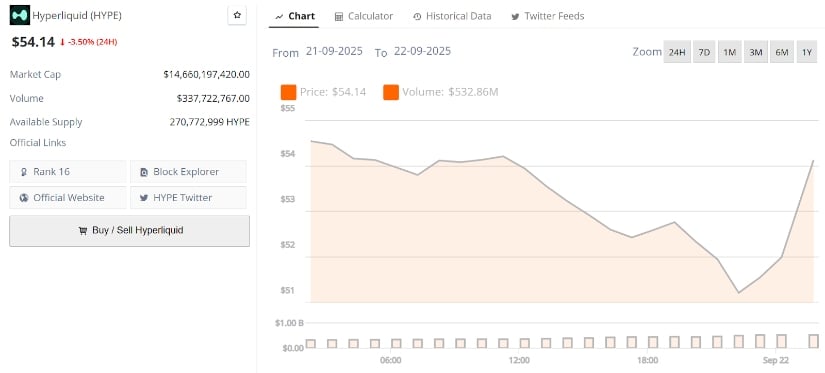

Hyperliquid’s current price is $54.14, down -3.50% in the last 24 hours. Source: Brave New Coin

Arthur Hayes Exits HYPE Position

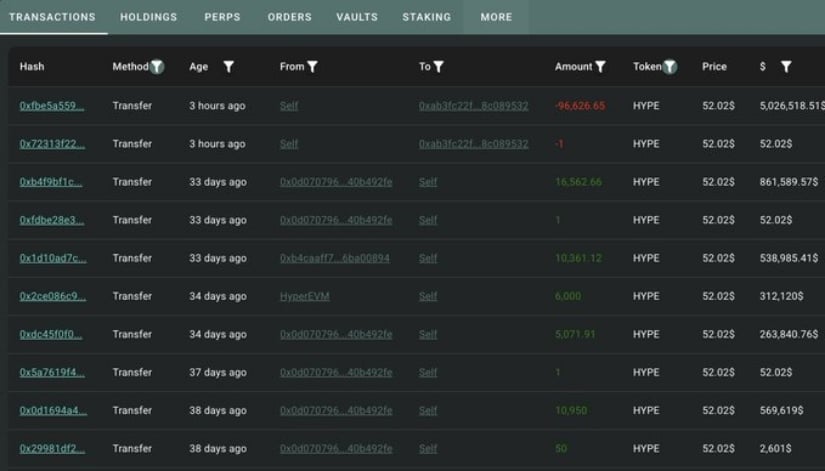

Arthur Hayes has officially closed his position in HYPE, selling all 96,628 tokens. The exit earned him around $823K, a 19.2% profit, far below the bold 126x upside he predicted during his WebX Summit speech in August. The move reflects a cautious stance, suggesting Hayes preferred to lock in profits rather than hold through the ongoing volatility.

Arthur Hayes cashes out $823K from his HYPE position. Source: Lookonchain via X

For the market, his exit sends mixed signals. While a 20% gain in just a month underscores the strength of HYPE’s recent performance, the fact that Hayes didn’t stay committed to his original projection could raise eyebrows among traders.

Market Shift: Hyperliquid Starting to Struggle

Since ASTER’s launch, Hyperliquid has seen its market cap shrink by over $2 billion, a sign that investor attention may be rotating towards the new entrant. The contrasting charts tell the story clearly: ASTER has surged with strong upward momentum, while HYPE has been trending lower, unable to maintain its previous highs. The sharp divergence is fueling talk of a “flippening,” where ASTER begins to outpace HYPE in both growth and sentiment.

Hyperliquid’s market cap drops by over $2B as ASTER gains momentum, sparking talk of a possible “flippening.” Source: Whale.Guru via X

This shift introduces a more cautious undertone for HYPE holders. Combined with recent profit-taking moves from big names like Arthur Hayes, the drop in market cap suggests confidence is being tested. While HYPE’s fundamentals remain intact, the short-term narrative is showing cracks, and sustaining momentum here will require a stronger rebound.

Hyperliquid Short-Term Price Structure Flips Bearish

Hyperliquid has slipped into a fragile technical zone after the 4H structure broke to the downside, with price sliding into the $51 area. The chart highlights a clear shift in momentum, with sellers pushing price into the demand block. This zone is now being tested as short-term support, but without a decisive reversal, the broader bias leans cautious.

Hyperliquid breaks down to $51 as 4H structure flips bearish, with participants eyeing short-term support for signs of recovery. Source: Crypto Pirates via X

Crypto Pirates is watching closely for a 15m confirmation bounce, which could allow for quick recovery, but the bigger picture remains shaky. As long as the 4H structure stays broken, upside is likely to be treated as short-lived relief moves rather than a trend shift.

Contrary View: HYPE’s Structure Still Holds Up

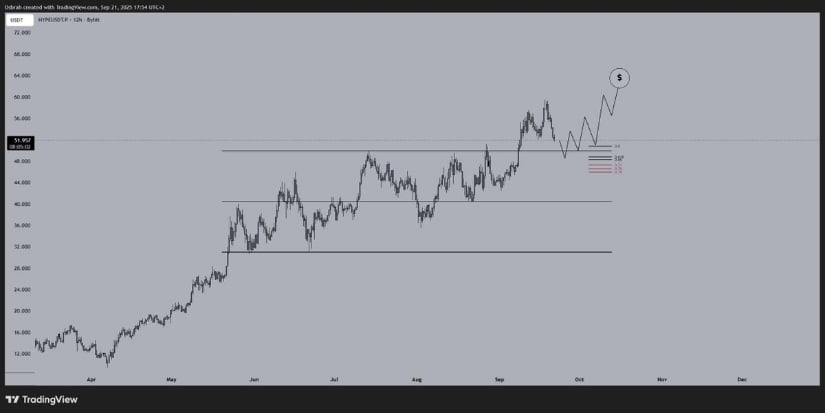

While recent sessions showed weakness, this chart highlights a more constructive setup for HYPE. The price is likely to sustain the bullish formation. Hyperliquid’s structure on a broader time frame is still pointing upward despite short-term pullbacks.

Analyst Osbrah notes HYPE’s broader trend stays intact, with mid-$40 support zones fueling recovery and keeping the bullish structure alive. Source: Osbrah via X

Key demand levels around the mid-$40k range continue to act as a safety net, and so far, each dip into support zones has been met with steady recovery. The projection laid out suggests price could retest prior highs before attempting a new leg up.

Analyst Osbrah supports this perspective, noting that the overall trend is intact and that current movements appear to be part of a re-accumulation phase rather than a breakdown. According to his chart, as long as HYPE maintains its rising base, the Hyperliquid price prediction remains constructive.

Final Thoughts

Hyperliquid’s short-term weakness has certainly raised eyebrows, especially with Arthur Hayes stepping aside and ASTER stealing some market share. Yet, zooming out tells a different story. The broader structure still leans bullish, and as long as HYPE continues to hold its mid-range support, recovery attempts remain very much on the table. The next few sessions will be crucial in determining whether this dip is just a pause before continuation or the start of deeper cracks.

On a brighter note, Hyperliquid can maintain relevance against fresh competition. If support levels keep holding and re-accumulation plays out as analysts suggest, the Hyperliquid price prediction still points toward a constructive path rather than a collapse.

3 months ago

40

3 months ago

40

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·