“Advanced couch potato” anything might sound like an oxymoron, but hear us out. First, couch-potato investing is not just for people who hate investing. Lots of smart investors have recognized that they can get competitive returns at very low cost using index funds and a passive methodology. They might combine it with individual stock holdings, GICs, and bonds.

They recognize, too, that there are more fish in the sea than the stock and bond indices represented in core portfolios. They may seek to spice up returns or further diversify with, say, a high-yield bond or crypto fund. There’s no limit to the add-ons you can apply to a couch portfolio.

Second, there are those who get the hang of managing a core portfolio, like the results, and, upon gaining investment knowledge and experience, feel comfortable raising the complexity of their holdings. Couch potato investing offers a good entry level to more sophisticated investing, by which time your nest egg will likely have grown and gained a momentum all its own.

While the core exposures should always represent a majority of any long-term investment portfolio, here are some asset types available through ETFs that typically aren’t represented in core portfolios:

Small-cap equities Emerging-market equities Foreign bonds High-yield bonds Money markets and high-interest savings accounts (HISAs) Gold and other commodities Cryptocurrency Alternative strategies (leveraged, inverse and hedge funds) Private assetsThere may also be segments of the investible universe already embedded within core portfolios that an investor might seek to increase their exposure to:

Sector-specific equities (e.g. REITs) Country-specific equities (e.g. India) Dividend stocks Corporate bonds Short- or long-duration bondsCompare the best TFSA rates in Canada

American investor Ray Dalio famously created an “all-weather portfolio” that he claimed would hold up in almost any market environment. It broke down like this: 30% U.S. stocks, 40% long-term treasury bonds, 15% intermediate bonds, 7.5% commodities, and 7.5% gold. Should you so choose, you could create a reasonable facsimile to the all-weather portfolio using ETFs.

Our MoneySense columnists have likewise illustrated how you can further diversify a core portfolio, reducing the risk of losses.

Here’s one such strategy, augmenting an asset-allocation fund with cash and/or gold bullion that would have held up well through past market downturns. And there’s another that adopts the buzzy 40/30/30 portfolio model that includes exposure to alternative assets along with stocks and bonds.

If you think you might be ready to take the next step beyond investing just in Canadian bonds and the major investible regions for equities, consider one of the advanced portfolios listed below. These are just suggested allocations that we believe won’t lead you too far astray. Feel free to tweak them to better suit your circumstances and build on them over time.

An important note: As your portfolio gets more complex, it will be harder to fill each allocation with index mutual funds and asset-allocation ETFs, which is why index ETFs are the go-to vehicle for building an advanced portfolio. We’ve suggested some funds, but with some 1,500 ETFs trading in Canada, know that there will be comparable competing products out there, possibly with lower fees or other attractive attributes.

Consider our fund picks suggestions only. For up-to-date ETF recommendations from the experts, check out MoneySense’s guide to the best ETFs in Canada, which we update every year in May.

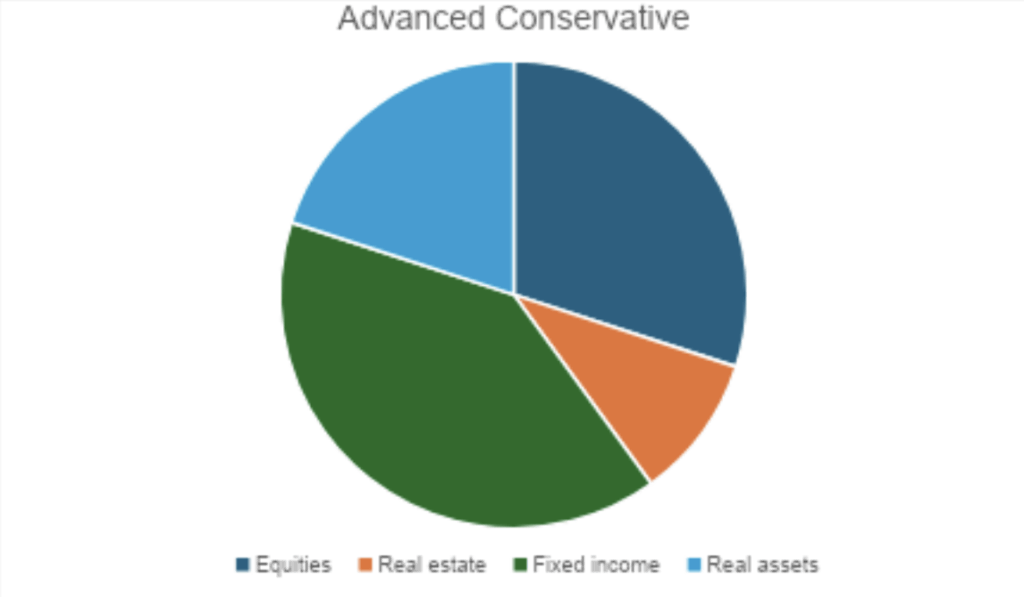

Advanced conservative portfolio

Equities: 30%

Canada – iShares Core S&P/TSX Capped Composite Index ETF (XIC): 10% U.S. – iShares Core S&P 500 Index ETF (XUS): 10% Developed International – iShares Core MSCI EAFE IMI Index ETF (XEF): 5% Developing International – Vanguard FTSE Emerging Markets All Cap Index ETF (VEE): 5%Real estate: 10%

iShares Global Real Estate Index ETF (CGR): 10%Fixed income: 40%

Canadian long-term bonds – BMO Long Federal Bond Index ETF (ZFL): 15% Canadian short-term bonds – iShares Core Canadian Short Term Bond Index ETF (XSB): 10% U.S. treasuries – BMO Long-Term US Treasury Bond Index ETF (ZTL): 15%Real assets: 20%

Purpose Diversified Real Asset ETF (PRA): 20%

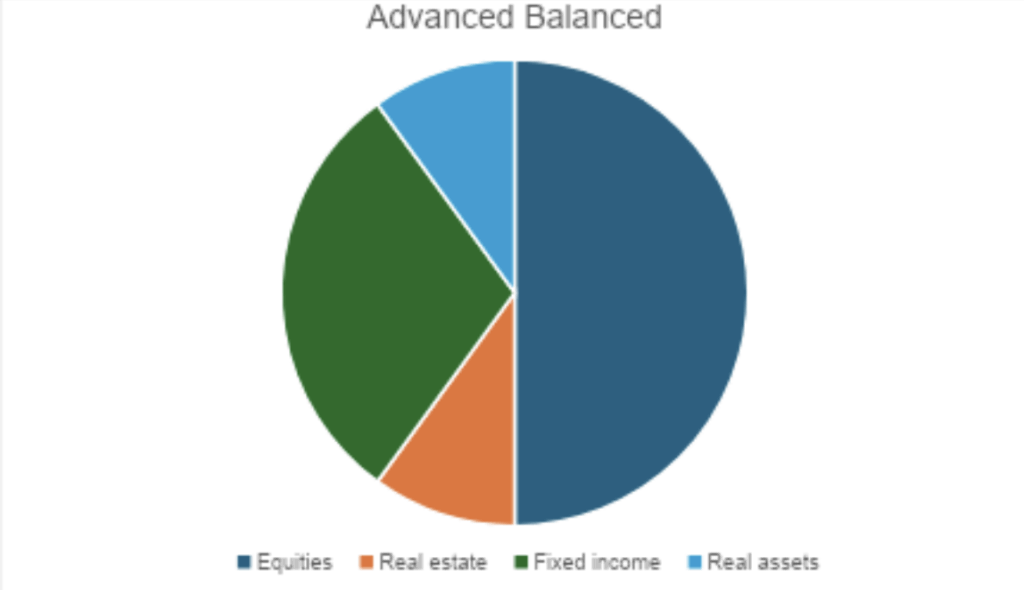

Advanced balanced portfolio

Equities: 50%

Canada – iShares Core S&P/TSX Capped Composite Index ETF (XIC): 16.7% U.S. – iShares Core S&P 500 Index ETF (XUS): 16.7% Developed International – iShares Core MSCI EAFE IMI Index ETF (XEF): 8.33% Developing International – Vanguard FTSE Emerging Markets All Cap Index ETF (VEE): 8.33%Real estate: 10%

iShares Global Real Estate Index ETF (CGR): 10%Fixed income: 30%

Canadian long-term bonds – BMO Long Federal Bond Index ETF (ZFL): 10% Canadian short-term bonds – iShares Core Canadian Short Term Bond Index ETF (XSB): 10% U.S. Treasuries – BMO Long-Term US Treasury Bond Index ETF (ZTL): 10%Real assets: 10%

Purpose Diversified Real Asset ETF (PRA): 10%

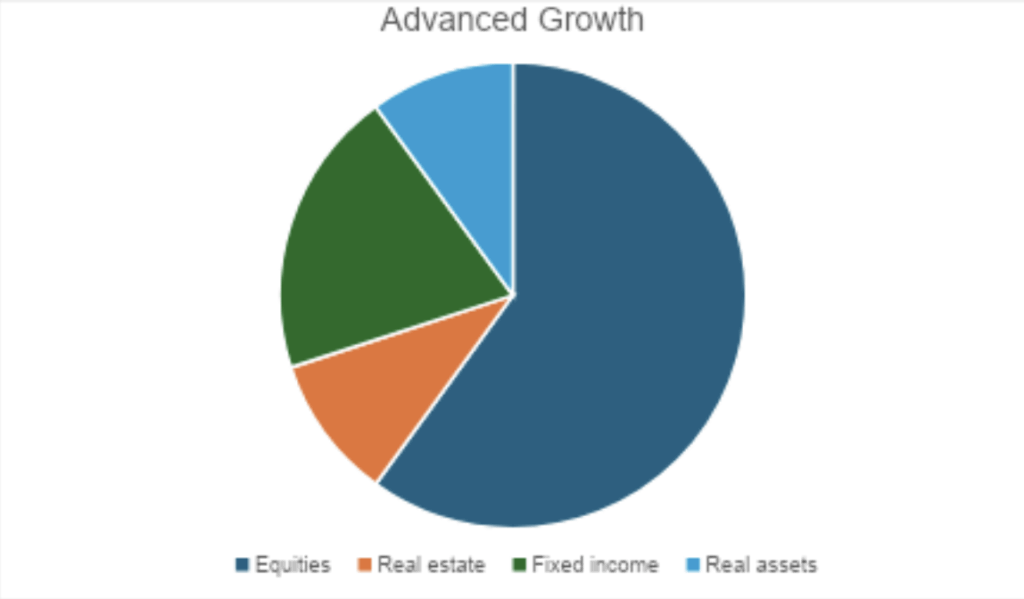

Advanced growth portfolio

Equities: 60%

Canada – iShares Core S&P/TSX Capped Composite Index ETF (XIC): 20% U.S. – iShares Core S&P 500 Index ETF (XUS): 20% Developed International – iShares Core MSCI EAFE IMI Index ETF (XEF): 10% Developing International – Vanguard FTSE Emerging Markets All Cap Index ETF (VEE): 10%Real estate: 10%

iShares Global Real Estate Index ETF (CGR): 10%Fixed income: 20%

Canadian long-term bonds – BMO Long Federal Bond Index ETF (ZFL): 6.6% Canadian short-term bonds – iShares Core Canadian Short Term Bond Index ETF (XSB): 6.6% U.S. Treasuries – BMO Long-Term US Treasury Bond Index ETF (ZTL): 6.8%Real assets: 10%

Purpose Diversified Real Asset ETF (PRA): 10%

Get free MoneySense financial tips, news & advice in your inbox.

The post How to build an advanced couch potato portfolio appeared first on MoneySense.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·