The token recently bounced from a key Fibonacci support block, igniting discussions of higher targets among analysts.

With multiple chart insights converging, holders are closely watching whether the asset can extend momentum toward long-term resistance levels while maintaining structural support.

Fibonacci Support Block Reinforces Bullish Structure

According to an analysis shared on X by ChartNerd, HBAR has successfully bounced off the 0.382 Fibonacci retracement level at $0.22, reinforcing this price zone as a crucial support block.

The chart depicts a strong flagpole formation, followed by a corrective flag pattern, which eventually resolved into another upward leg. This continuation setup reinforces a bullish bias, indicating that the trend remains intact as long as the price remains above the identified Fibonacci levels.

Source: X

The analysis highlights a clear path toward higher resistance levels, with Fibonacci extensions indicating $1.20 and $1.80 as the next major upside targets. These zones align with the 1.272 and 1.414 Fibonacci extensions, which often act as natural resistance points in trending markets. The price structure suggests that maintaining strength above $0.22 would provide buyers with the momentum needed to pursue these higher targets over the coming months.

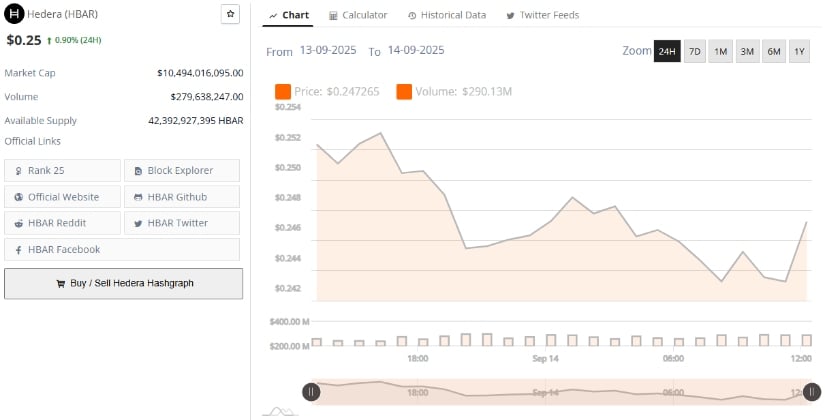

Market Data Shows Strength in Fundamentals

According to BraveNewCoin, data provides further confirmation of Hedera’s growing momentum, with the token trading at $0.25 at the time of writing. The token’s market capitalization stands at $10.49 billion, securing its position within the top 25 digital assets by rank.

In addition, its 24-hour volume of $279.6 million highlights consistent trading activity, signaling both retail and whale participation in the current cycle.

Source: BraveNewCoin

The available circulating supply of 42.39 billion tokens underscores the scale of the network, which continues to expand its ecosystem across enterprise and institutional use cases. This supply figure, combined with ongoing developments, gives context to the token’s relatively stable market presence.

Despite being up just 0.90% in the past 24 hours, the broader market structure and on-chain accumulation suggest that long-term positioning may outweigh short-term price fluctuations.

Elliott Wave Outlook Suggests Higher Targets Ahead

Another perspective was shared on X by analyst Nology (@nology3000), who presented an Elliott Wave count that supports the possibility of a broader impulsive move. According to this view, the current price action remains tame but consistent with an early-stage impulse structure.

Nology emphasizes that while corrective movement may persist into mid-October, such a phase would fit within the framework of a Wave 2 pullback, typically followed by a strong Wave 3 advance.

Source: X

If validated, this Elliott Wave structure could position HBAR for a significant upward trajectory, with projections extending as high as $4 over the coming months.

The critical condition, however, lies in avoiding an invalidation of the impulse by breaking decisively below structural supports. As long as the corrective phase remains controlled, the setup maintains a high-reward profile for holders awaiting confirmation of the next bullish leg.

2 hours ago

4

2 hours ago

4

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·