In a recent post, Daan explained how large ETF inflows or outflows can provide clues about underlying market absorption and potential reversals—even when price action appears to stall.

“When we see big inflows after a big run, but price refuses to move higher, it often signals a local top,” he wrote. Conversely, large outflows after a correction with no further drop in price may indicate a local bottom, as selling pressure is absorbed.

This behavior, Daan suggests, reflects market participants using ETF flows to accumulate or distribute positions while awaiting price confirmation.

The post concludes with a simple rule of thumb:

Big inflows + no price continuation upward = Bearish Big outflows + no price continuation downward = BullishREAD MORE:

JPMorgan Finally Lets Clients Buy Bitcoin

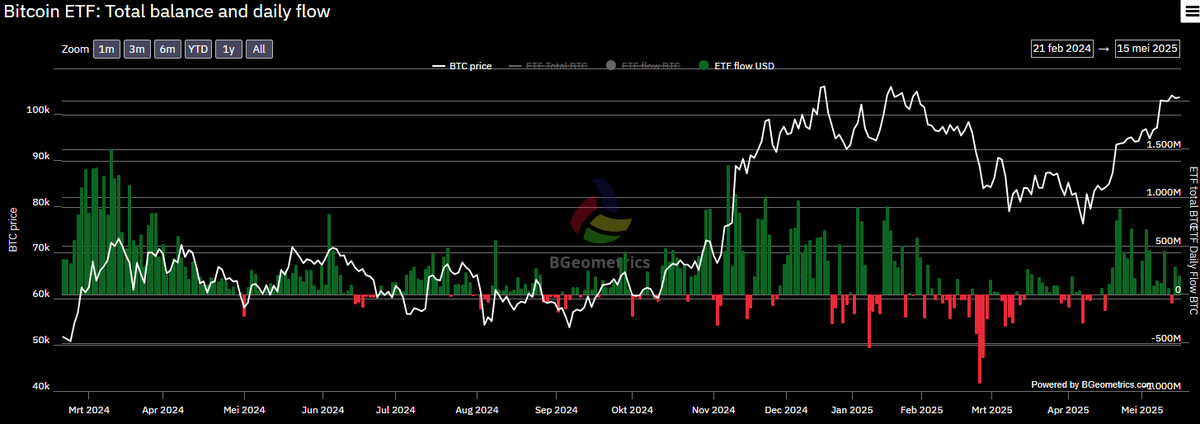

An attached chart shows BTC ETF balances and daily flows over the past year, with green and red bars representing inflows and outflows respectively, plotted against Bitcoin’s price action.

“ETF flows can be good for momentum, but be cautious and watch whether price actually follows through,” Daan emphasized.

As ETF products continue to grow in influence within crypto markets, especially in the wake of increased institutional adoption, their flows are becoming a valuable tool for traders and analysts seeking an edge in timing entries and exits.

The post ETF Flows Emerging as a Key Indicator for Bitcoin Market Tops and Bottoms appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·