Cryptocurrency markets are poised for an “up only” phase once the United States Treasury achieves its target, filling the General Account (TGA) with $850 billion, according to Arthur Hayes, co-founder of the BitMEX exchange. Hayes indicated that once this liquidity drain is complete, upward momentum in crypto markets could resume.

“With this liquidity drain completed, up only can resume,” Hayes wrote on Friday, noting the TGA’s opening balance exceeded $807 billion. Typically, funds allocated to the Treasury’s account are sequestered and not circulating in private markets, impacting overall liquidity.

However, skepticism remains among some analysts regarding Hayes’ optimistic outlook that liquidity will flow into the broader financial markets once the goal is reached. André Dragosch, the European research head at investment firm Bitwise, responded, “Net liquidity has only a loose correlation with Bitcoin and crypto, in my view, and I consider it somewhat irrelevant in assessing market movements.”

Many traders expect liquidity levels to increase in the coming months, driven by the Federal Reserve’s ongoing interest rate cuts, which historically have bolstered asset prices, including cryptocurrencies like Bitcoin and Ethereum. As liquidity increases, a potential rally could materialize until the Fed halts or reverses course, tightening monetary policy again.

US Federal Reserve Implements First Rate Cut of 2025

The Federal Reserve surprised markets by slashing interest rates by 25 basis points — the first reduction since 2024. This move triggered a brief dip in Bitcoin’s price below $115,000, demonstrating typical “sell the news” behavior that often accompanies rate adjustments.

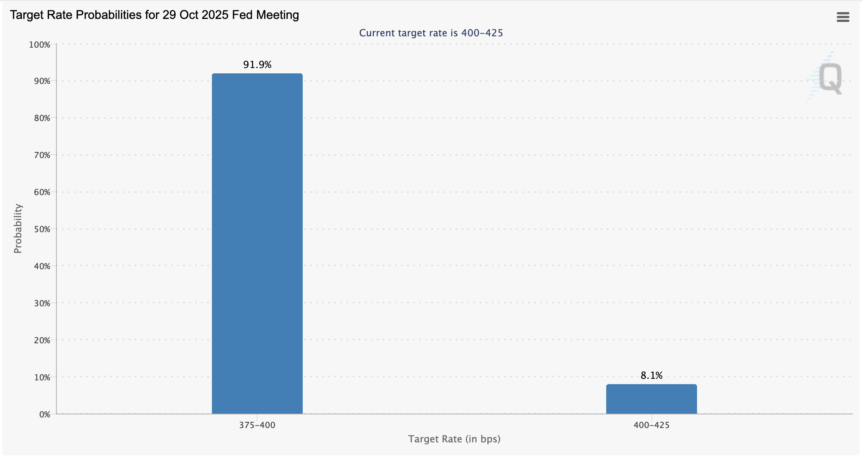

Coin Bureau founder Nic Puckrin cautioned that the recent correction might be temporary, noting that markets had likely priced in the rate cut well before it was announced. Federal Reserve Chair Jerome Powell emphasized that policymakers remain divided over further rate cuts in 2025, but very few traders now anticipate more than a 50 basis point reduction at the next meeting in October — with approximately 92% expecting a cut of that size according to data from the CME Group.

Source: CME Group

Source: CME Group

The broader outlook continues to influence crypto markets, as investors monitor central bank policies and their potential impact on the growing ecosystem of blockchain-based assets, including DeFi platforms and NFTs. As rate policies evolve, the trajectory of cryptocurrency prices—especially Bitcoin and Ethereum—remains tightly linked to macroeconomic developments and policy signals from the US Federal Reserve.

This article was originally published as Crypto Markets Surge After US Treasury Reaches $850 Billion Target: Analyst Predictions on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

3 months ago

45

3 months ago

45

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·