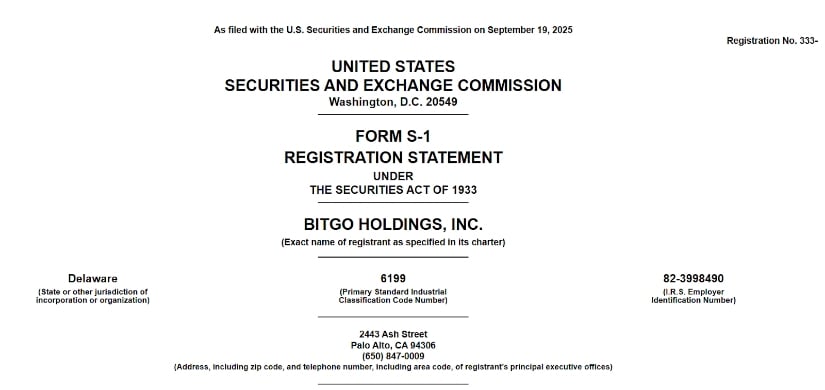

The Palo Alto-based company submitted paperwork to the Securities and Exchange Commission on September 19, 2025, seeking to trade on the New York Stock Exchange under the ticker “BTGO.”

The move comes as BitGo manages $90.3 billion in digital assets for institutional clients as of June 30, 2025. This massive scale makes it one of the largest crypto custody providers globally. The company serves more than 4,600 businesses and over 1.1 million users across 100 countries.

Founded in 2013, BitGo provides secure storage for cryptocurrencies. Think of it as a digital vault for banks, hedge funds, and crypto exchanges. The company uses advanced security methods to protect digital assets from hackers and theft.

Record-Breaking Revenue Growth

BitGo’s financial numbers show explosive growth. The company earned $4.19 billion in revenue during the first half of 2025. This represents nearly four times the $1.12 billion it made in the same period last year.

For the full year 2024, BitGo reported over $3 billion in revenue, up from $926 million in 2023. This marks more than 200% year-over-year growth.

However, profits tell a different story. Despite the massive revenue increase, net income dropped to $12.6 million in the first half of 2025, down from $30.9 million in the same period of 2024. Rising operating costs have squeezed profit margins as the company expands its infrastructure.

The asset concentration presents both opportunities and risks. Bitcoin makes up 48.5% of assets on the platform, followed by Sui at 20.1%, Solana at 5.7%, XRP at 3.9%, and Ethereum at 3.0% as of June 30, 2025. This concentration in five major cryptocurrencies creates exposure to price swings in these specific tokens.

Crypto IPO Wave Continues

BitGo joins a growing list of crypto companies going public in 2025. Circle, the company behind the USDC stablecoin, led the charge with a spectacular public debut in June. Circle’s stock jumped 168% on its first trading day, and now trades around 290% above its IPO price.

Source: sec.gov

Other crypto firms have followed suit. Bullish exchange went public in August with shares surging over 80% on debut, while Gemini launched its IPO in September. However, not all have maintained their initial gains. Gemini’s stock has fallen below its IPO price after an initial 14% gain.

The wave of public offerings reflects growing confidence in the crypto sector. Bitcoin recently climbed above $120,000, and the total cryptocurrency market has exceeded $4 trillion in value. These record highs have created strong investor appetite for crypto-related investments.

Regulatory Tailwinds

The regulatory environment has become more favorable for crypto companies. President Trump signed the GENIUS Act into law in July 2025, providing clearer rules for cryptocurrency businesses. This regulatory clarity has removed barriers that previously kept institutional investors away from digital assets.

BitGo has also expanded internationally. The company secured approval from Germany’s Federal Financial Supervisory Authority (BaFin) to offer services across the European Union under the Markets-in-Crypto-Assets (MiCA) framework. Additionally, BitGo is pursuing a U.S. bank charter, which would allow deeper integration with traditional banking systems.

Corporate Structure and Leadership

BitGo will use a dual-class share structure for its public offering. This means Class A shares (available to public investors) carry one vote each, while Class B shares held by insiders carry 15 votes each. Co-founder and CEO Michael Belshe will maintain control of the company through these special voting shares.

Goldman Sachs and Citigroup are leading the IPO as underwriters. Other major banks including Deutsche Bank, Mizuho, and Wells Fargo Securities are also participating. This level of Wall Street involvement shows mainstream financial institutions’ growing comfort with crypto businesses.

The company has not yet disclosed how many shares it plans to sell or at what price range. These details typically emerge closer to the actual trading date.

Market Position and Competition

BitGo’s custody business has grown rapidly as more institutions enter the crypto space. The company’s assets under custody jumped from $60 billion at the start of 2025 to over $100 billion by mid-year. This growth reflects the broader trend of institutional adoption of digital assets.

The custody market could reach $53.4 billion by 2030, according to industry projections. Traditional banks are also entering this space. U.S. Bancorp recently relaunched its crypto custody services after regulatory changes.

BitGo processes about 8% of all Bitcoin transactions by value, demonstrating its significant market presence. The company also generates revenue from staking services, where investors earn rewards by helping validate blockchain transactions. Half of BitGo’s assets under custody come from these staking activities.

The Road Ahead

BitGo’s path to public markets hasn’t been smooth. Galaxy Digital agreed to buy the company for $1.2 billion in 2021, but the deal collapsed during the 2022 crypto market crash. This failed acquisition may have worked in BitGo’s favor, as the company’s assets and valuation have grown substantially since then.

The IPO must still complete the SEC review process before shares can begin trading. BitGo has not provided a timeline for when this might happen.

Investors should consider both the opportunities and risks. While BitGo shows impressive growth in assets and revenue, the profit margins remain thin despite the massive scale. The concentration in a few major cryptocurrencies also creates volatility exposure.

Bottom Line: Custody King Goes Public

BitGo’s IPO filing marks a historic moment for crypto infrastructure companies entering mainstream markets. With over $90 billion in assets under management and explosive revenue growth, the company represents the maturation of crypto custody services. Success will depend on whether investors value the massive scale over concerns about profit margins and crypto volatility.

3 months ago

55

3 months ago

55

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·