The TL;DR of the “Satoshi-Era” Shuffle

Old money, huge returns. Those coins were mined or bought when BTC was US $0.78. At today’s price, the owner is sitting on a 14-million-percent gain. Same whale, eight mouths. On-chain sleuths at Arkham and Lookonchain say the wallets appear to belong to one entity, not eight separate OGs. No rush to sell—yet. The funds slid into brand-new, lower-fee addresses, not exchanges, which usually means “parked,” not “dumping.” Traders got wrecked anyway. The move flushed out over-leveraged longs below 108 K while shorts stacked up above 110 K—classic “toxic flow,” as market-makers call it.Why the Crypto Market Freaks Out About Dormant Coins

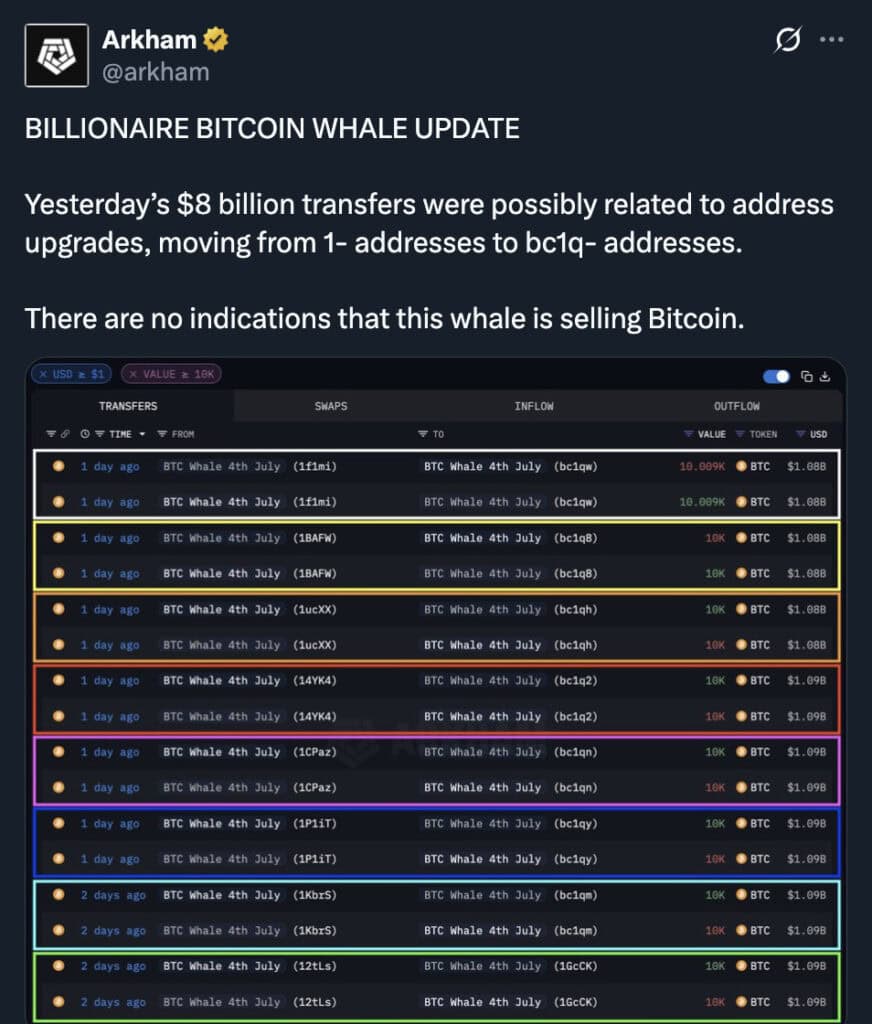

Supply shock paranoia. When decade-old coins move, algorithms assume a sell-off is coming, and the order books thin out. Narrative over math. “Maybe it’s Satoshi dumping!” is spicier than “an early miner rotated cold storage.” Headlines move faster than fundamentals. Liquidity crumbs. At US $108 K, even a 10,000-BTC market order could nuke price by several thousand dollars before the books refill. Everyone front-runs that fear.While we don’t know the entity of the OG, it is probably not Satoshi, it could be Roger Ver, or it could be someone else again. It’s more likely that they are doing some address hygiene, as Arkham points out in the tweet below.

Yesterday’s $8 billion transfers were possibly related to address upgrades, moving from 1- addresses to bc1q- addresses, Source: X

Is Now a Good Time to Buy Bitcoin (or Any Crypto)?

Let’s get contrarian—because buying the dip is only smart if the dip isn’t a manhole to the center of the earth. For those asking themselves if now is the right to buy Bitcoin, there are many factors to consider.

| Bullish Tailwinds | Bearish Headwinds |

| Spot-ETF flows keep coming. U.S. pension funds and chunky family offices auto-buy every month. | Macro wobble. If the Fed telegraphs a surprise rate hike next quarter, risk assets, including BTC, will wobble. |

| Post-halving scarcity. Miner sell-pressure dropped 50 % in April 2024; that supply shock hasn’t fully priced in. | Over-leveraged derivatives. Perpetual funding rates are flirting with “greed” territory again. A single whale can rinse them, as we just saw. |

| Emerging-markets bid. Argentina and Nigeria keep breaking volume records on P2P desks—real demand, not leverage. | Regulatory crosshairs. The EU’s MiCA rules kick in fully next month; some liquidity providers may exit Europe, shrinking order books. |

My Take

Short term: Volatility is the feature, not a bug. The whale transfer spooked algos, but the fact that those coins didn’t hit an exchange is quietly bullish. Unless a follow-up “deposit to Coinbase” alert hits, expect a mean-reversion bounce once the panic sellers dry up.

Medium term: We’re in the awkward adolescence of the cycle—post-halving optimism wrestling with macro uncertainty. If you believe Bitcoin will print another all-time high before the next halving (historically, it does), laddering buys between US $100 K and US $107 K looks reasonable.

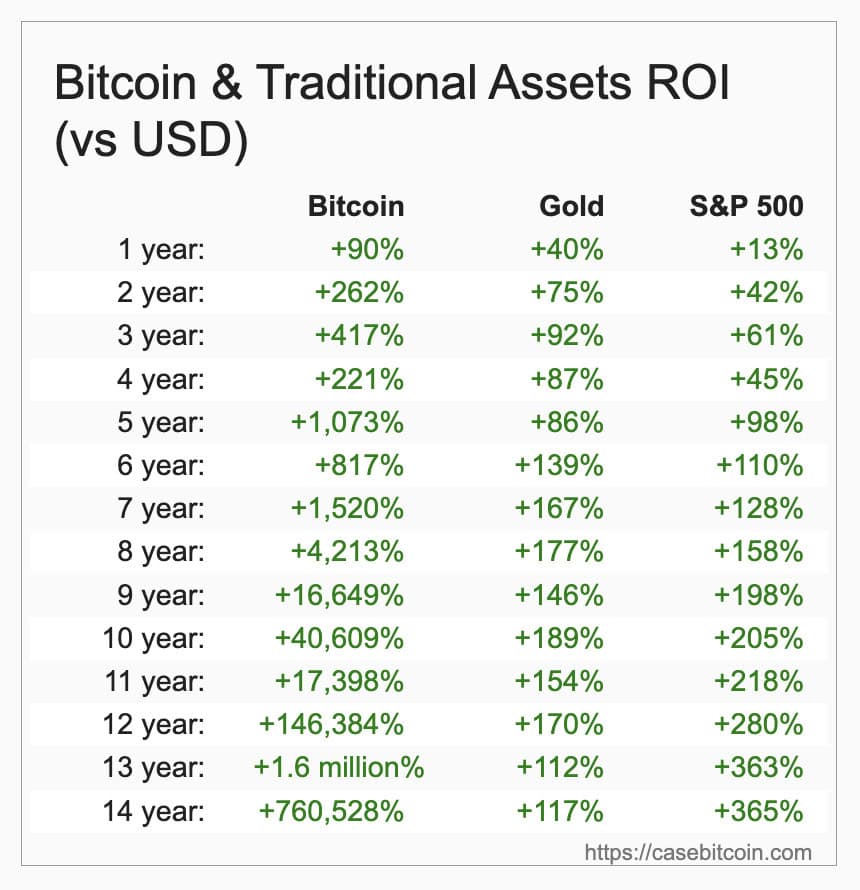

Long term: The fundamentals haven’t budged. Fixed supply, expanding institutional rails, and nation-state debt theatrics still scream “hard money.” If you’re dollar-cost averaging, this whale splash is just noise. As long as you have a long-term investment time horizon, Bitcoin is still likely to beat all other asset classes. Just take a look at the chart below. Bitcoin looks good on any time frame right now.

Bitcoin continues to beat all other asset classes, Source: Case Bitcoin

Risk Management 101 for Would-Be Dip-Buyers

Size your position for a 30 % drawdown. If you can’t stomach BTC at 75 K, you’re over-allocated. Use cold storage. The whale’s 14-year dormancy should remind you that self-custody still works. Avoid 20× leverage. Unless you enjoy donating to market-makers.Final Word

A single entity just reminded the crypto market that Bitcoin’s real supply is even tighter than we imagine—most coins never move. The fireworks spooked traders, but fundamentally nothing broke. If you’ve been waiting for an excuse to start or top-up a Bitcoin investment, you’ve got a volatility coupon in hand. Just remember: conviction beats headlines, and Satoshi probably isn’t selling to fund a yacht. Our Bitcoin price prediction is still new all time-highs, followed by $170,000. Time frame unknown!

Not financial advice—just one tech blogger’s unapologetically forward-looking opinion.

12 hours ago

1

12 hours ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·