TLDR

Dell Technologies (DELL) delivered record Q2 revenue of $29.8 billion, up 19% year-over-year, beating analyst expectations The company raised full-year revenue guidance to 12% growth and increased earnings outlook to 17% growth for fiscal 2026 Dell’s AI server business generated $8.2 billion in quarterly revenue with an $11.7 billion order backlog pointing to continued growth ASML (ASML) stock has dropped 30% from its July 2024 peak due to export restrictions limiting sales to China Both stocks trade at attractive valuations with Dell at 13x forward earnings and ASML at historically low P/E ratiosDell Technologies has been quietly building one of the most compelling AI infrastructure stories on Wall Street. The company just posted record quarterly results that should have investors taking notice.

The tech giant reported $29.8 billion in revenue for its fiscal second quarter. That represents a 19% jump from the same period last year. Earnings per share hit $2.32 on a non-GAAP basis.

Dell Technologies Inc. (DELL)

Dell Technologies Inc. (DELL)

Both numbers beat Wall Street expectations. Yet the stock dropped nearly 9% the day after earnings. That reaction looks like a mistake.

AI Servers Driving the Growth Engine

Dell’s AI server business tells the real story here. The company shipped $8.2 billion worth of AI servers in the quarter. That’s a record number that shows just how hungry the market is for this equipment.

The first half of fiscal 2026 has already produced $10 billion in AI server revenue. That’s more than Dell generated from this segment in all of last year. The math is pretty straightforward.

Fresh orders worth $5.6 billion came in during the quarter. Dell’s AI server order backlog now sits at $11.7 billion. That gives the company clear visibility into future revenue.

Management expects to hit $20 billion in AI server revenue for the full year. The previous forecast was much lower. This updated target would double last year’s AI server revenue.

The AI server market is expected to grow at 34% annually through 2030. That market could reach $837 billion by the decade’s end. Dell appears positioned to grow faster than the overall market.

Margins Set to Improve as Business Scales

Dell’s margins have taken a hit recently. The company has been ramping up production to meet demand. That typically pressures profitability in the short term.

Management expects margins to improve in the second half of the year. The AI server business should become more profitable as it scales up. This is a common pattern in manufacturing.

The company raised its earnings guidance for fiscal 2026. Dell now expects 17% earnings growth compared to the previous 15% forecast. Revenue guidance increased by four percentage points to 12% growth.

ASML Faces Different Challenges

ASML presents a different investment opportunity in the AI space. The Dutch company makes the machines that produce the world’s most advanced chips. Without ASML’s equipment, modern semiconductors wouldn’t exist.

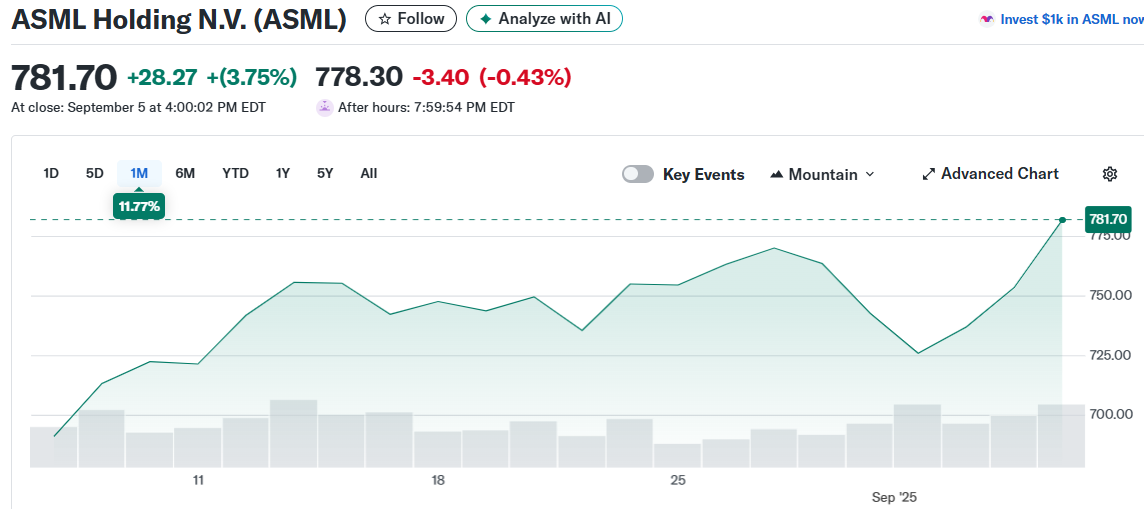

ASML Holding N.V. (ASML)

ASML Holding N.V. (ASML)

The stock has fallen 30% from its July 2024 peak. Export restrictions limiting sales to China have weighed on investor sentiment. The Dutch and U.S. governments have tightened rules around what technology can be exported.

ASML generated 7.7 billion euros in Q2 sales. That came in at the high end of guidance. Management had been cautious due to uncertainty around trade restrictions.

The company expects Q3 sales between 7.4 billion and 7.9 billion euros. Conservative guidance continues to reflect trade uncertainty. This cautious approach may be creating an opportunity for patient investors.

ASML trades at historically low valuation multiples. The forward P/E ratio hasn’t been this cheap since 2023. No other company can make the extreme ultraviolet lithography machines needed for cutting-edge chips.

Dell’s 12-month price target sits at $150 according to 27 analysts. That implies 24% upside from current levels. The stock trades at just 13 times forward earnings while the Nasdaq 100 trades at 29 times.

The post Best AI Stocks To Buy Now According To Top Analysts appeared first on CoinCentral.

5 hours ago

6

5 hours ago

6

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·