Arbitrum has started to separate itself from the rest of the market, showing strength at a time when most major chains are struggling. While Ethereum, Solana, and even Bitcoin have seen dips in activity, ARB continues to attract liquidity and build momentum.

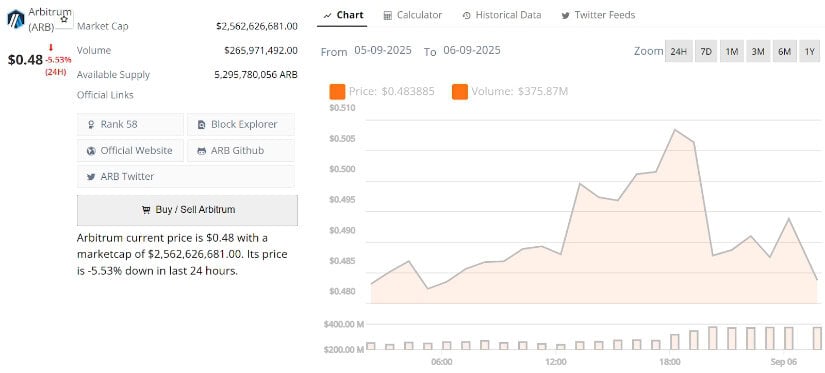

Arbitrum’s current price is $0.48, down -5.53% in the last 24 hours. Source: Brave New Coin

At the same time, technical charts are lining up with bullish formations that suggest bigger moves ahead. From a clean W-bottom breakout to a cup-and-handle structure forming over months, Arbitrum’s price action looks like it’s building for something for Q4 2025.

Arbitrum Shows Strength While Others Pull Back

While most major chains have posted red numbers over the past week, Arbitrum stands out as the only network showing positive growth in total value locked (TVL). According to Jesse Peralta, ARB recorded a +1.55% gain over seven days, contrasting with declines across Ethereum, Solana, Bitcoin, and others. This divergence highlights how Arbitrum continues to quietly attract liquidity even in a cooling market, reinforcing its position.

Arbitrum’s TVL climbs +1.55% in a weak market, standing out as the only major network with positive growth. Source: Jesse Peralta via X

Such steady inflows suggest confidence from users and protocols building on Arbitrum’s network. Maintaining growth when others retrace often signals underlying demand and adoption strength. If this trend extends, it could help Arbitrum price to out rally other coins technically.

ARB Sees a Perfect Breakout Retest

Adding to its resilience shown in TVL growth, Arbitrum’s chart structure is starting to align with a bullish technical setup. Analyst Daniel Ramsey points out a completed W-bottom pattern with a successful breakout and retest of the neckline around the $0.45 to $0.46 range. This retest is crucial, as it often validates the breakout and provides a base for further continuation. Holding above this level keeps the pattern intact and opens the door toward higher targets.

Arbitrum retests the W-bottom neckline at $0.45–$0.46, strengthening its bullish setup for targets towards $0.55 and $0.65. Source: Daniel Ramsey via X

From a technical perspective, the next resistance sits closer to $0.55, with further upside potential stretching toward $0.65 if momentum builds. The W-pattern breakout fits neatly with Arbitrum’s recent ability to attract liquidity even in a weak market.

Cup-and-Handle Structure Pointing $0.95

Following the weekly W-bottom, Arbitrum’s daily chart is now hinting at a similar bullish formation on a lower time frame. Analyst Sjuul from AltCryptoGems points to a developing cup-and-handle formation that has been taking shape over the past eight months. Price is holding above the flipped support/resistance at $0.46, which strengthens the structure and suggests that ARB is preparing for the next leg higher. As long as this level holds, the technical case for continuation remains intact.

Arbitrum forms an 8-month cup-and-handle pattern, eyeing a breakout move towards $0.95 for nearly 100% upside. Source: Sjuul via AltCryptoGems

If momentum confirms the handle breakout, the measured move points towards $0.95 as the next major resistance. Such a setup would mark a near 100% rally from current levels, but more importantly, it reflects how Arbitrum has been steadily carving out higher lows across the year. With its growing network momentum and repeated successful retests, ARB is building both technical and fundamental support for a bullish continuation.

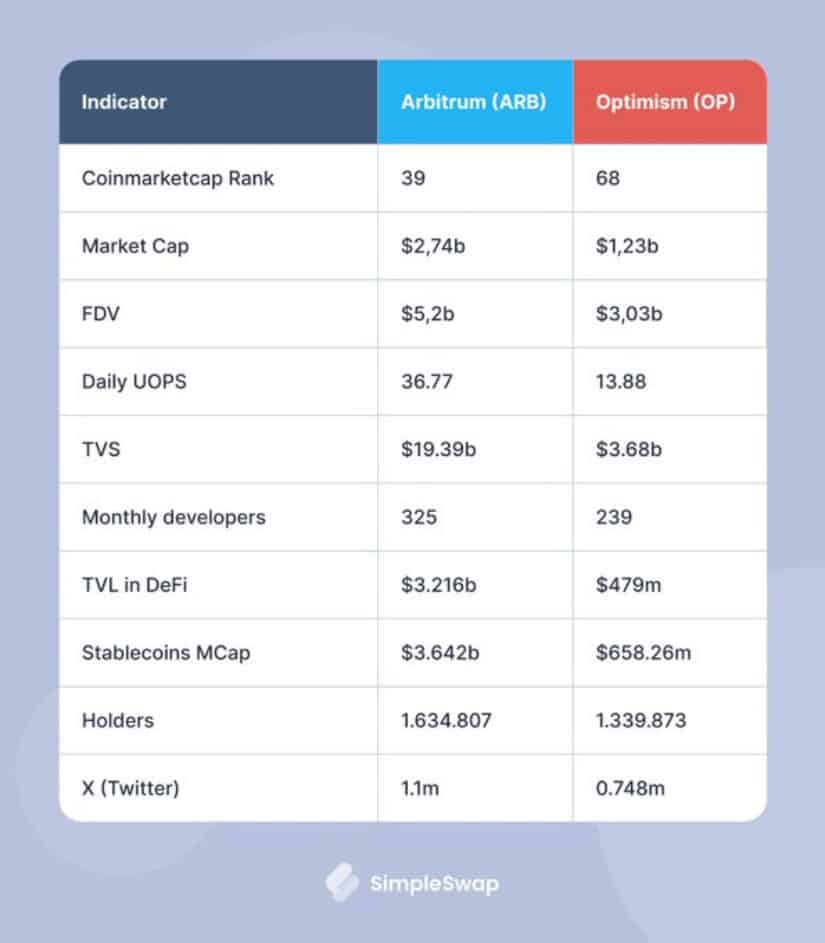

Arbitrum vs Optimism

In a latest comparison, ARB on-chains has taken a clear lead over other Ethereum Layer 2s, cementing itself as the top player in terms of liquidity, adoption, and overall usage. The gap with Optimism is especially telling, Arbitrum holds more than double the market cap and commands stronger TVL, daily users, and stablecoin flows.

ARB doubles Optimism’s market cap and leads L2s in TVL, users, and liquidity, strengthening its dominance. Source: SimpleSwap via X

If Ethereum starts heating up again, ARB could be the first in line to benefit. With the biggest user base and liquidity pool among L2s, it has the setup to ride that momentum faster than the rest. A strong ETH season usually lifts its scaling networks, and right now, ARB Arbitrum looks best placed to take advantage.

Final Thoughts: ARB Outlook for Q4 2025?

Arbitrum’s combination of steady TVL growth, bullish chart structures, and its clear lead over Optimism paints a strong picture heading into the final quarter of 2025. The successful breakout retests and developing cup-and-handle setup suggest that ARB has built a solid technical foundation. If momentum continues, the path toward higher resistance levels like $0.65 and even $0.95 looks realistic.

That said, much will depend on broader crypto sentiment and Ethereum’s performance. If ETH kicks off a strong Q4 run, ARB Arbitrum price is well-positioned to ride that wave faster than other Layer 2s, thanks to its dominance in adoption and liquidity.

3 months ago

38

3 months ago

38

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·