TLDR

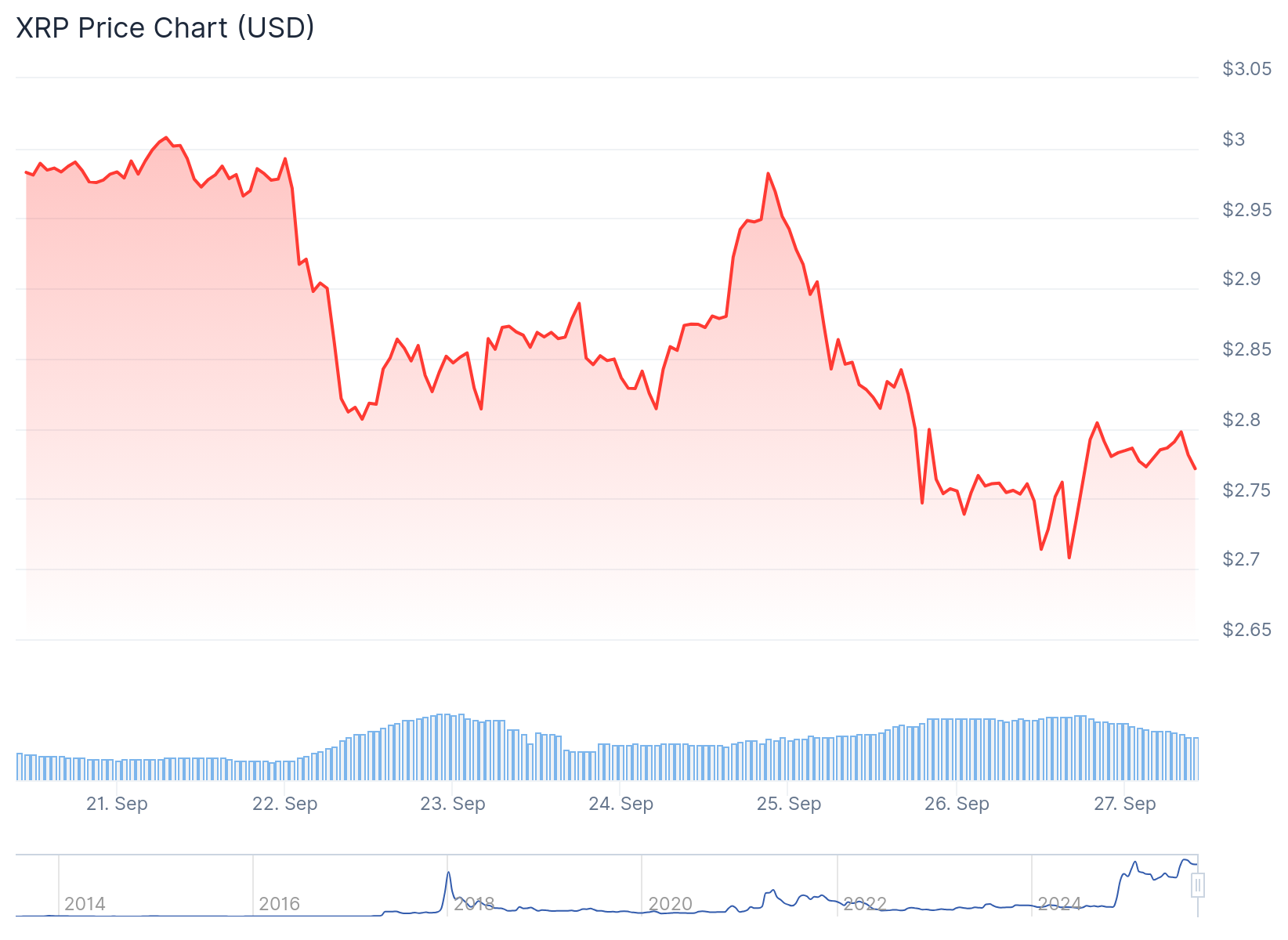

XRP trades near $2.80 after defending the $2.70 support level multiple times in recent weeks Technical analysis shows RSI near 40 indicating weak demand, while MACD stabilizes suggesting selling pressure may be easing BlackRock executive discusses potential XRP ETF evaluation based on client demand, market cap, and liquidity factors Analysts identify potential retest of $2.50-$2.55 zone based on fractal patterns and onchain data showing buyer clusters XRP enters third compression phase since November 2024 elections, with Franklin Templeton ETF decision pushed to November 14XRP is currently trading close to $2.80 after successfully rebounding from the crucial $2.70 support level. The cryptocurrency has been moving within a defined range over the past month, with a low of $2.70 and a high of $3.18.

XRP Price

XRP Price

Crypto analyst Ali has identified $2.70 as a critical level that XRP must maintain to keep alive its chances of reaching $3.20. Technical charts reveal this support has been tested multiple times throughout August and September. Buyers have consistently stepped in around the $2.70-$2.72 range during these tests.

$XRP must hold $2.70 support to keep the chance of a rebound to $3.20 alive! pic.twitter.com/RZGL4DtJV9

— Ali (@ali_charts) September 26, 2025

The technical setup shows that holding above $2.70 could pave the way for a recovery toward $3.00-$3.20. A confirmed breakout above $3.20 might lead to a price rally toward the July high of $3.66. However, a break below $2.70 could send XRP toward $2.20-$2.50, with longer-term support identified at $2.00.

Current momentum indicators present mixed signals for the cryptocurrency. The Relative Strength Index sits near 40, suggesting low demand in the market. A move above the RSI midpoint of 50 would signal renewed buying interest among investors.

The MACD histogram shows slightly negative readings but appears to be stabilizing. These technical indicators suggest that while selling pressure persists, the downside momentum may be weakening.

ETF Development Updates

BlackRock Head of Digital Assets Robbie Mitchnick recently discussed the evaluation process for new cryptocurrency products. While not confirming plans for a spot XRP ETF, Mitchnick explained that such decisions depend on client demand, market capitalization, liquidity, and strategic fit.

XRP’s market position strengthens its case for ETF consideration. With a market cap exceeding $165 billion, it ranks as the third-largest non-stablecoin cryptocurrency. This comes after BlackRock’s Bitcoin and Ethereum ETFs secured inflows of $60.25 billion and $13.35 billion respectively.

The REX-Osprey XRP ETF has already demonstrated investor interest, recording $37.7 million in first-day trading volume. Meanwhile, Franklin Templeton’s XRP ETF decision has been delayed until November 14.

Technical Analysis and Market Structure

Onchain data from Glassnode reveals a dense cluster of buyers between $2.45 and $2.55 based on the Unrealized Price Distribution. This suggests strong support in that price range where many holders have their cost basis.

The current price action shows similarities to XRP’s fractal pattern from Q1 2025. The cryptocurrency has already tested the $2.65 level twice, following a historical structure that often includes a sweep below key levels before sustainable rallies begin.

Market researcher Sistine Research notes that XRP is approaching a potential expansion phase. The narrow price action over the past 10 weeks has compressed the order book into a tighter range, creating larger gaps between price levels.

Expecting a large expansionary move from XRP soon (within months).

As the price action compresses, so does the orderbook, with most liquidity compressing into a tighter and tighter range.

This results in very large gaps in liquidity.

XRP is on its 3rd compression since the… pic.twitter.com/hjRVzeK8wc

— Sistine Research (@sistineresearch) September 24, 2025

XRP is currently in its third compression phase since the November 2024 elections. This compression is built on three consecutively higher price points, conditions that have historically preceded sharp breakouts when liquidity builds up and then gets released.

Crypto analyst Pelin Ay observes that spot market flows show an ongoing battle between buyers and sellers. The 90-day spot taker CVD indicates sellers remain in control despite brief periods of buyer strength earlier in 2025.

A sustained upside move would require a decisive volume shift from buyers, which has not yet materialized in the current market environment.

The post XRP Price: Bulls Defends Key Support as Blackrock ETF Momentum Builds appeared first on CoinCentral.

1 hour ago

6

1 hour ago

6

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·