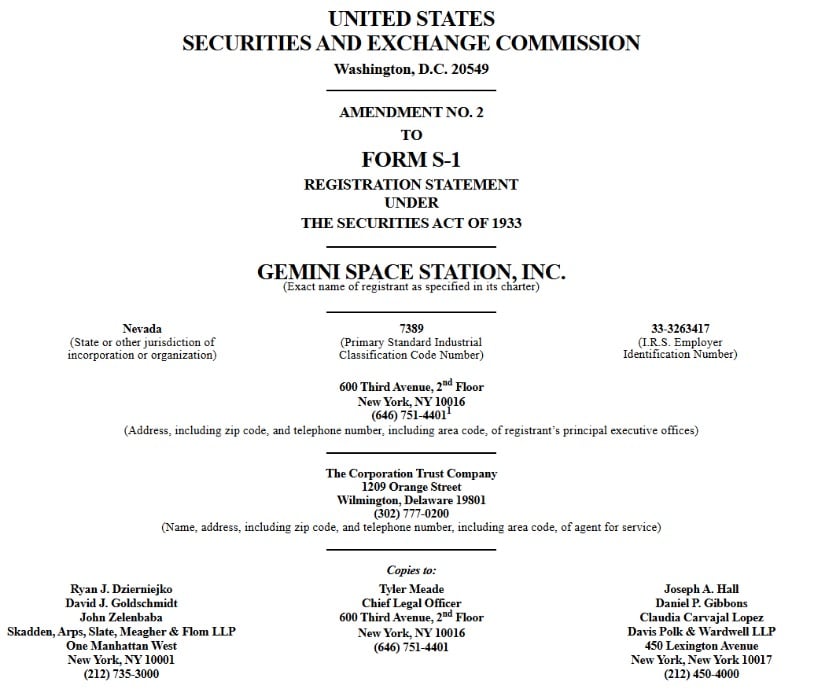

The cryptocurrency exchange Gemini has officially filed paperwork to go public, seeking to raise up to $317 million in what could become one of the biggest crypto IPOs of 2025.

If priced at the top of this range, Gemini would achieve a valuation of approximately $2.22 billion. The exchange will trade on the Nasdaq Global Select Market under the ticker symbol “GEMI.”

Major Banks Lead the Deal

Goldman Sachs and Citigroup will serve as lead underwriters for the offering, with Morgan Stanley and Cantor acting as additional bookrunners. This backing from major Wall Street firms signals confidence in Gemini’s public market prospects.

The IPO comes at a time when crypto companies are finding renewed success in public markets. Circle, the stablecoin issuer, saw its stock jump 168% on its first trading day after going public in June. Similarly, crypto exchange Bullish raised $1.1 billion and watched its shares surge over 80% on debut.

Strong Business Foundation

Gemini manages over $18 billion in customer assets and serves 14.6 million verified users worldwide. The company offers a full range of services including cryptocurrency trading, digital asset custody, staking services, and a crypto rewards credit card.

The exchange reported $142.2 million in revenue for 2024, up from $98.1 million in the previous year, reflecting increased trading activity as Bitcoin and other digital assets gained value. Founded in 2014, Gemini has built its reputation on a “security-first” approach to crypto services.

Beyond basic trading, Gemini issues its own stablecoin called the Gemini Dollar (GUSD) and provides institutional-grade custody services to over 10,000 business clients. The company recently expanded its offerings by launching an XRP-focused credit card and adding support for Ripple’s RLUSD stablecoin.

Regulatory Tailwinds Support Timing

Gemini’s IPO timing takes advantage of a much more favorable regulatory environment for crypto companies. President Trump signed the GENIUS Act into law in July 2025, creating the first comprehensive federal framework for stablecoins in the United States.

Source: sec.gov

This legislation requires stablecoin issuers to maintain full reserves backed by U.S. dollars and Treasury securities. It also establishes clear anti-money laundering requirements and consumer protections that were previously unclear.

The new rules give compliant U.S. crypto companies like Gemini significant advantages over offshore competitors. Companies with strong regulatory compliance frameworks are now better positioned to win institutional customers who demand clear legal oversight.

Financial Challenges and Strategic Backing

Despite revenue growth, Gemini faces some financial headwinds. The company reported a net loss of $282.5 million in the first half of 2025, compared to a $41.4 million loss in the same period of 2024. Cash reserves have also declined from $341.5 million at the end of 2024 to $161.9 million by June 2025.

However, Gemini has secured strategic financial backing to support its growth plans. The company has a $75 million credit facility from Ripple, with the option to extend this to $150 million if needed. This provides additional liquidity as the company prepares for its public debut.

The Winklevoss twins will maintain control of the company through a dual-class share structure. Class A shares sold to the public will carry one vote each, while the twins will retain all Class B shares that carry ten votes per share.

Market Positioning for Growth

If successful, Gemini would become the third major crypto exchange to trade on U.S. stock markets, joining Coinbase and the recently public Bullish. This puts the company in an exclusive group of regulated crypto exchanges with access to public capital markets.

The exchange’s compliance-focused approach differentiates it in an industry that has faced significant regulatory scrutiny. While competitors have dealt with enforcement actions, Gemini has built relationships with regulators and maintained licenses in multiple jurisdictions.

Industry experts view stablecoins as the most practical application of blockchain technology for mainstream finance. With the GENIUS Act providing clear rules, regulated stablecoin issuers like Gemini are positioned to benefit from increased institutional adoption.

The company’s regulatory compliance strategy could prove valuable as traditional financial institutions look for trusted crypto partners.

Path Forward

Gemini’s IPO paperwork has been filed, but the company still needs SEC approval before shares can begin trading. The exact IPO date will depend on how quickly regulators complete their review and whether market conditions remain favorable.

The success of recent crypto IPOs suggests strong investor appetite for well-positioned digital asset companies. Circle’s stock price surged significantly after going public, while Bullish achieved a substantial market valuation increase on its first day of trading.

Gemini’s offering will test whether investors view regulatory compliance and institutional focus as valuable enough to justify the company’s target valuation despite current losses.

What This Means Moving Forward

Gemini’s IPO represents another step in the mainstream acceptance of cryptocurrency businesses. The combination of clearer regulations, successful precedents, and institutional backing suggests crypto companies are transitioning from speculative investments to legitimate financial services providers.

22 hours ago

7

22 hours ago

7

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·