Bitcoin is back in focus as it hovers around $115,120, approaching a price range that analysts warn could decide the market’s next direction. Traders are now eyeing the $117,780 mark, which has historically acted as both a magnet for demand and a ceiling for rallies. With BTC sitting near record territory, how the market reacts at this level could determine whether momentum accelerates into new highs – or stalls into another volatile consolidation. While Bitcoin tests this critical zone, whales are also rotating into high-upside opportunities, with MAGACOIN FINANCE tipped for a potential 36x return in October.

The $117.8K Resistance Zone

Market analyst Joao Wedson identifies $117,000 to $118,000 as the key battleground for Bitcoin. He notes that “any price above $117,000 enters a zone of strong interest and indecision,” where sellers often defend aggressively, but buyers remain eager to push higher. The most recent local high at $117,780 confirms this, marking the latest point where the rally paused before pulling back.

Wedson argues that only a decisive break above $118,000 would confirm strength strong enough to attract new capital and sustain further upside. Until then, traders should expect volatility around these levels, as sentiment remains divided between bullish momentum and profit-taking.

Indicators Converge Around Critical Levels

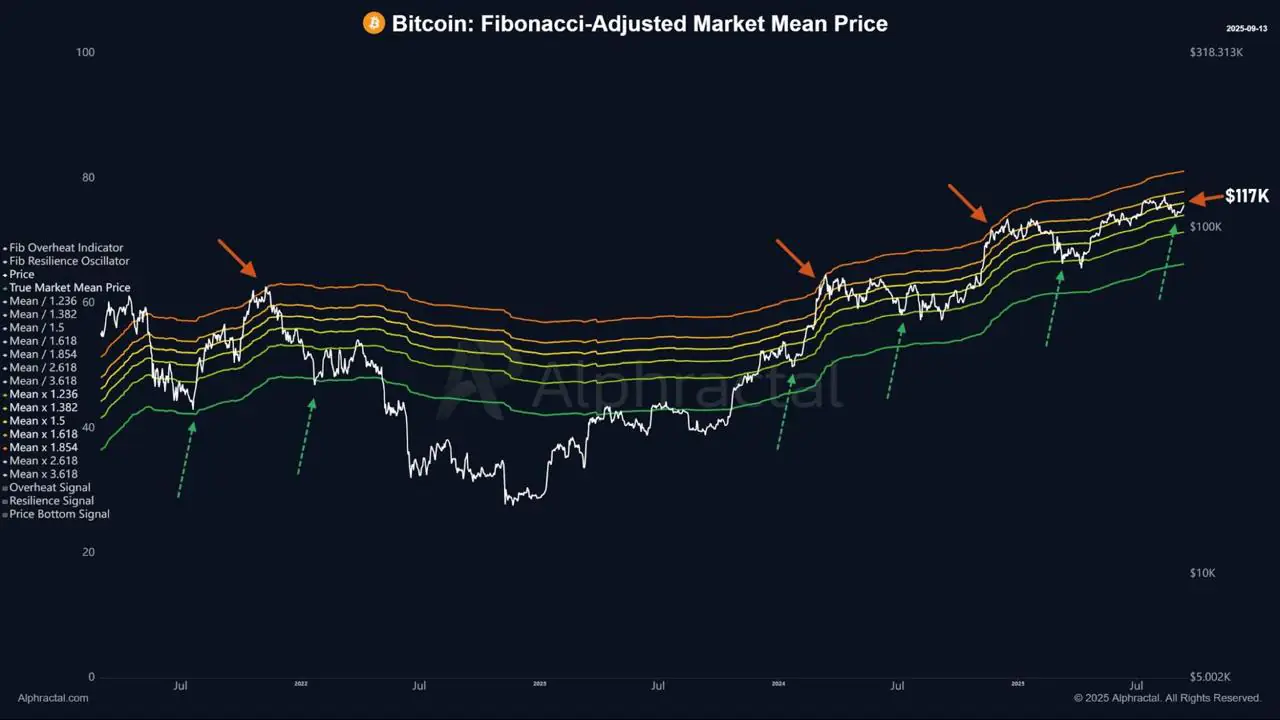

Wedson also highlights technical models such as the CVDD Channel and the Fibonacci-Corrected Market Average Price, both of which flag the same zone as a potential turning point. When multiple independent indicators cluster in one region, the probability of significant market reaction rises.

This convergence means that the $117K–$118K area is not just psychological resistance, but also reinforced by deeper structural signals. If Bitcoin clears it, analysts say a new surge could follow quickly. Failure, however, risks a repeat of late August price action, when BTC reversed sharply after testing the same band.

Altcoin Rotation Begins

While Bitcoin wrestles with resistance, MAGACOIN FINANCE is seizing attention from whales and retail traders alike. Analysts tracking flows say capital from Bitcoin ETF profits is moving into the project, which has already built strong momentum in its presale phase. Projections of 36x returns in October reflect the kind of appetite investors have for high-upside altcoins at moments when Bitcoin’s gains slow near resistance.

MAGACOIN FINANCE’s appeal lies in its ability to capture both community growth and speculative energy at an early stage. It isn’t positioned as a competitor to Bitcoin, but as a complementary play – one that offers the potential for exponential growth even as BTC remains bound within narrow ranges. This timing has made it one of the standout altcoins of the season.

What a Breakout – or Failure – Means for Bitcoin

If Bitcoin clears $118,000 with conviction, analysts believe the path toward new highs opens rapidly. Strong daily closes above resistance would attract momentum buyers, potentially carrying BTC toward uncharted levels before year-end. Such a move would likely lift other large-cap altcoins and add fuel to the ongoing bull market narrative.

On the other hand, if Bitcoin struggles to maintain traction near $117,780, the rally could lose steam, triggering another round of volatility. A pullback toward the $112,000–$113,000 support zone would not break the broader bullish outlook but would extend the consolidation phase and test trader patience.

Market Outlook

The coming days are critical as Bitcoin sits just below levels that have repeatedly shaped its trajectory in past cycles. Macroeconomic factors — including expectations of a Federal Reserve rate cut and rising ETF inflows – could tilt the balance. A dovish Fed stance or confirmation of fresh institutional demand may provide the push needed to crack resistance. Conversely, hawkish surprises or risk-off sentiment in equities could embolden sellers.

Conclusion

Bitcoin’s trade near $115,120 places it within striking distance of a make-or-break level at $117,780. Analysts agree that this range will decide whether the market gears up for another explosive rally or slips into a new consolidation. As the battle plays out, MAGACOIN FINANCE offers traders an alternative growth story, with whale accumulation and projections of 36x returns positioning it as one of the top altcoin opportunities in October.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Warning for Bitcoin Traders: Price Nears Make-or-Break Moment appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·