Key Points

The national unemployment rate has inched up to 4.3%, a shift that convinced the Federal Reserve to cut interest rates for the first time since December 2024. But headlines about the overall labor market only tell part of the story.

When you break down unemployment rates by education level, a striking pattern emerges: people with college degrees face significantly lower chances of losing their jobs compared with those who never earned one.

For decades, data from the Bureau of Labor Statistics has shown a clear trend—more education usually means steadier employment - highlighting another benefit in the ongoing debate of whether college is worth it.

High school dropouts are now experiencing unemployment rates more than double those of bachelor’s degree holders. At the same time, individuals with only some college or an associate degree sit somewhere in the middle, underscoring the sharp differences tied to educational attainment.

The gap matters for more than just paycheck stability. It influences how families weather economic downturns, how likely borrowers are to default on their student loans, and how quickly workers can recover from recessions. While the pandemic temporarily upended the picture, unemployment rates for college graduates normalized far faster than for other groups, highlighting once again the protective effect of higher education.

Looking at the unemployment rates by degree level provides more perspective. College graduates not only earn more, but they are also less likely to lose their jobs.

Would you like to save this?

Unemployment By Educational Attainment

There's a clear trend: unemployment rates decrease with increases in education level. Just as college graduates are less likely to default on their student loans, as compared with college dropouts, they are also much less likely to be unemployed.

Data from the Bureau of Labor Statistics provides the unemployment rates by educational attainment for people age 25 and older.

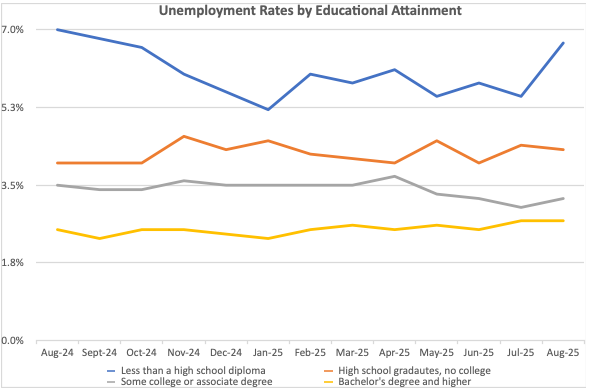

High school dropouts: 6.7%High school graduates with no college: 4.3%High school graduates with some college: 3.2%Bachelor’s degree or higher: 2.7%This chart shows how the unemployment rates for people age 25+ have changed over the last 12 months. The unemployment rates for people with less education are much more volatile than the unemployment rates for people with more education. The unemployment rates for people with Bachelor’s degrees did not change since last month, while the unemployment rates for high school dropouts increased from 5.5% to 6.7%, a big jump.

Source: Mark Kantrowitz analysis of Bureau of Labor Statistics Data

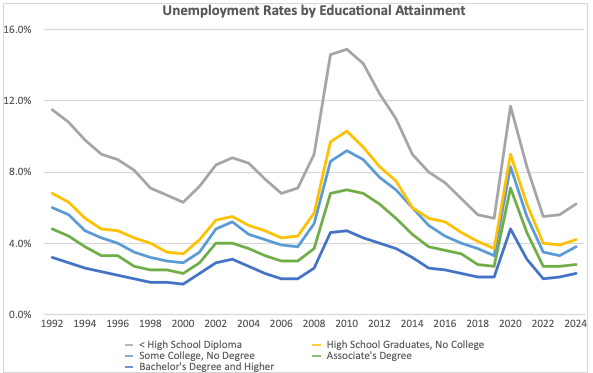

This chart shows annual unemployment rates by educational attainment from 1992 to 2024. It demonstrates that the unemployment rates consistently decrease as educational attainment increases.

Source: Mark Kantrowitz analysis of Bureau of Labor Statistics Data

A similar chart published by the Bureau of Labor Statistics shows that unemployment rates tend to increase during recessions and decrease afterward for all degree levels.

As shown in the unemployment rates chart, unemployment rates increased significantly in 2020 and 2021 across all educational levels, due to the pandemic. It started in April 2020 and normalized by November 2021, 20 months later, for Bachelor’s degree recipients.

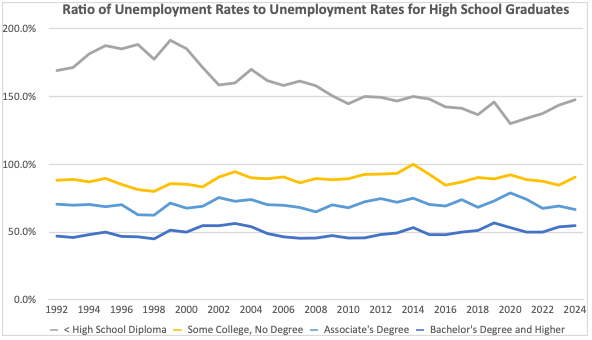

Ratio Of Unemployment Rates

To eliminate some of the volatility, we can calculate the ratio of the unemployment rates for each degree level to the unemployment rates for high school graduates, as shown in this chart. Most of the volatility in unemployment rates disappears, except for people who have less than a high school diploma. People with a Bachelor’s degree or more advanced degree have half the unemployment rates of people with just a high school diploma.

Source: Mark Kantrowitz analysis of Bureau of Labor Statistics Data

The Future Of Unemployment And Economic Hardship Deferments

The unemployment and economic hardship deferments are intended to provide financial relief to borrowers who lose their jobs.

The unemployment deferment suspends the borrower’s repayment obligation for borrowers receiving unemployment benefits, or who are looking for and unable to obtain full-time work (defined as 30+ hours per week that is expected to last for at least 3 months).The economic hardship deferment suspends the borrower’s repayment obligation for borrowers who are receiving public assistance, who are serving in the Peace Corps, who are working full time (30+ hours per week) but earning less than the federal minimum wage ($7.25 per hour) or who have income less than 150% of the poverty line for their family size and state.Both of these deferments are provided up to a maximum of three years in increments of up to one year.

The unemployment deferment was added by the Higher Education Amendments of 1986 and the economic hardship deferment was added by the Higher Education Amendments of 1992. The One Big Beautiful Bill Act of 2025, however, repealed both deferments for new borrowers as of July 1, 2027. Borrowers who lose their jobs will have to use a general forbearance, which will be limited to 9 months out of every 24 months.

The average duration in unemployment is 24.3 weeks, according to the Bureau of Labor Statistics (BLS). The median duration, however, was 9.8 weeks, suggesting that some people have a very long duration of unemployment, bringing up the average. Only 27.7% have a duration of unemployment of 27 weeks or more, with 11.5% having a duration of 27 to 51 weeks and 16.3% having a duration of a year or more.

This suggests that 9 months of general forbearance should be sufficient for about three-quarters of unemployed borrowers. Borrowers with longer-term unemployment will need to switch into an income-driven repayment plan.

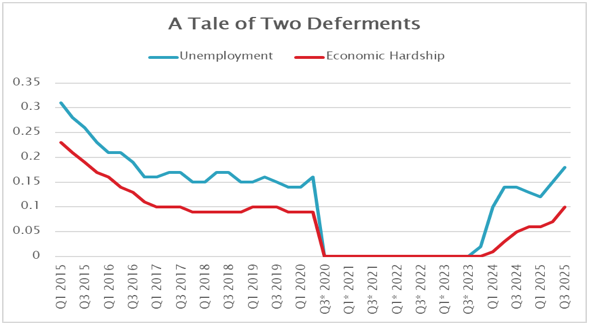

This chart shows the utilization of the two deferments (in millions of borrowers) over the last decade. The use of these deferments dropped to zero during the pandemic’s payment pause. Use of these deferments correlates with changes in unemployment rates otherwise.

Source: Mark Kantrowitz analysis of Federal Student Aid Data

Final Thoughts

The latest data reinforces a long-standing pattern: education remains one of the most reliable safeguards against unemployment. Those with bachelor’s degrees or higher are less exposed to labor market swings than those with only a high school diploma.

But as student loan policy shifts, particularly with the repeal of unemployment and hardship deferments for new borrowers, students and graduates alike will need to weigh the stability of their career prospects against the reality of repayment.

The broader message is clear. A degree may lower the odds of joblessness, but it does not make anyone immune. Borrowers should be prepared to navigate new repayment rules if they experience a spell of unemployment, using tools such as income-driven repayment when temporary relief through deferment or forbearance no longer exists.

For today’s students and recent graduates, that combination of education and planning will matter most in turning a degree into long-term financial security.

Don't Miss These Other Stories:

Editor: Robert Farrington

The post Unemployment Rates By Education Level appeared first on The College Investor.

1 hour ago

3

1 hour ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·