The stablecoin operator has been steadily adding to its treasury, scooping up more than 27,000 BTC in the last twelve months alone.

According to data shared by CEO Paolo Ardoino, part of the allocation went straight into USDT’s reserves, while the bulk was funneled into a separate vehicle, Twenty One Capital, which Tether uses to manage longer-term digital asset positions. This approach gives the company both immediate backing for its stablecoin and a separate investment arm designed to grow over time.

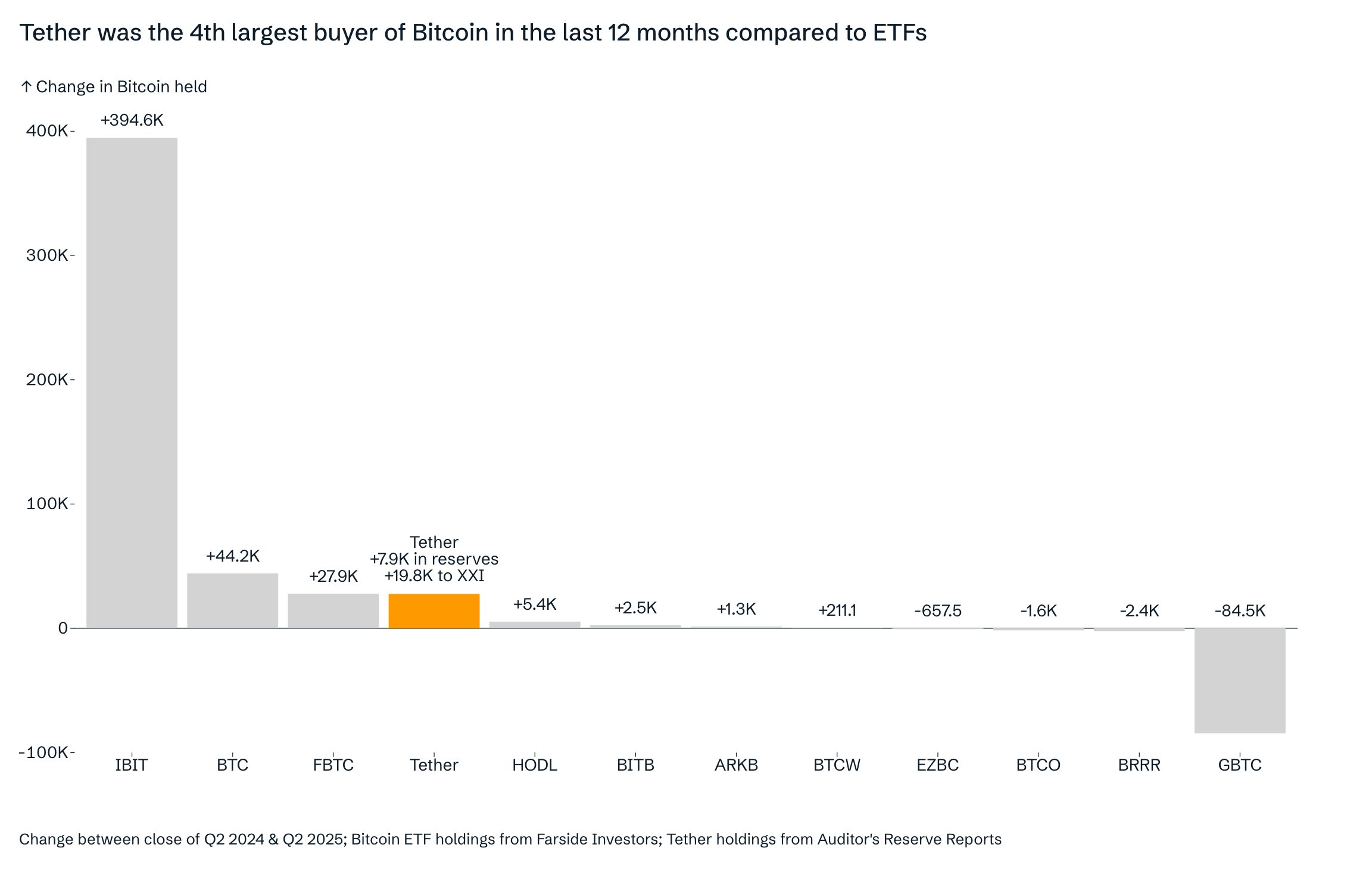

Outpacing ETFs – Except the Giants

That level of buying power puts Tether ahead of several U.S. spot ETF products — including those from VanEck, Bitwise, Ark 21Shares, and WisdomTree. Only the heaviest hitters, such as BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s downsized trust, have absorbed more Bitcoin during the same period. With 100,521 BTC now on its books, worth roughly $11.3 billion, Tether ranks as the third-largest corporate holder worldwide.

A Structured Policy and Growing Scrutiny

Unlike many firms that buy Bitcoin opportunistically, Tether has a standing rule dating back to May 2023: 15% of its quarterly profits go into BTC. The decision effectively turned Bitcoin into a permanent fixture of the company’s balance sheet, a policy that distinguishes it from most peers in the fintech sector.

Still, the strategy has drawn skepticism. Some critics pointed to changes in Tether’s public asset disclosures and speculated that it sold billions in BTC to purchase gold. Ardoino pushed back, clarifying that coins had been moved into Twenty One Capital rather than liquidated. He also stressed that diversification remains part of the plan, with reserves spread across Bitcoin, gold, and even real estate.

More Than Just a Stablecoin Operator

While Tether is known globally as the issuer of USDT, its role in Bitcoin accumulation signals something broader. The company is positioning itself not just as a liquidity provider for crypto markets, but also as a long-term investor with a structured treasury strategy. As ETF giants and corporate treasuries compete for supply, Tether’s quiet but consistent buying underscores how demand for Bitcoin is expanding well beyond traditional investment vehicles.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Tether Surpasses ETFs as One of Bitcoin’s Largest Corporate Buyers appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·