Charts are flashing early breakout signals that could shift momentum upward. With steady participation in play, the asset now sits at a decisive turning point.

Hidden Accumulation and Breakout Signals

According to Barry from ChartMonkey, sharing insights, Stellar is showing clear signs of hidden accumulation within a major demand zone. This level has historically attracted strong buying interest, suggesting sellers may be losing strength while buyers gradually step in. Such setups often precede strong price reversals, making this zone crucial for the cryptocurrency’s next move.

Source: X

Barry highlights that the asset has already broken out of a descending channel, which had been defined by lower highs and lower lows. This breakout signals a potential shift in sentiment from bearish to bullish. For traders, this is often the first technical confirmation that momentum could be building toward the upside.

Looking ahead, Barry notes that if demand continues to hold, the memecoin could first challenge minor resistance levels before aiming for stronger resistance zones. However, a breakdown below the demand area would negate this outlook, emphasizing the need for cautious monitoring as the next trend direction unfolds.

Price Action Steadies with Market Support

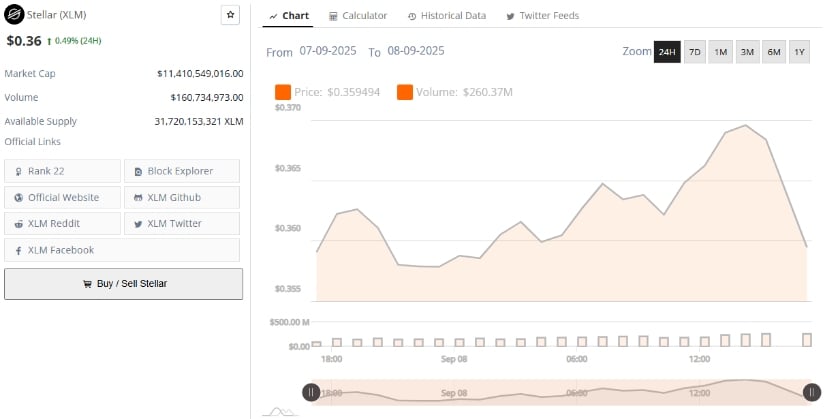

Additionally, BraveNewCoin data show Stellar trading around $0.36, showing a modest daily increase of 0.49%. The coin holds a market capitalization of approximately $11.4 billion, with over 31.7 billion tokens circulating. Trading volume remains steady, reflecting healthy activity that supports both liquidity and potential momentum.

Source: BraveNewCoin

This stability comes at an important point, as the price sits near critical support zones that align with Barry’s analysis. If accumulation continues in this zone, it could serve as a launchpad for the crypto’s next leg upward. Analysts note that the next minor resistance to watch sits near $0.38–$0.39, followed by stronger resistance closer to $0.43.

In the medium term, market forecasts suggest potential appreciation toward $0.43–$0.47 by late 2025, with some optimistic projections eyeing the $1 mark in the coming years. This outlook, however, remains contingent on sustained demand and defense of key supports, particularly above $0.34.

Key Indicators Outline The Next Move

At the time of writing, Stellar trades at $0.3710, recording a 2.60% intraday gain. The price sits between the lower Bollinger Band ($0.3335) and the upper band ($0.4213), suggesting controlled volatility with room for expansion. The middle band, currently near $0.3774, acts as immediate resistance just above the live price.

Source: TradingView

The Chaikin Money Flow (CMF) stands slightly negative at -0.03, signaling mild selling pressure despite recent gains. This reflects a cautious market where accumulation is taking place, but buyers are still waiting for stronger confirmation before scaling in aggressively.

Traders are watching for a breakout above the middle Bollinger Band paired with improving CMF levels as a bullish trigger. Conversely, a move below the lower band could shift momentum back to sellers. For now, the crypto remains balanced between cautious optimism and risk, making the $0.37 range a critical battleground for short-term direction.

5 hours ago

7

5 hours ago

7

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·