TLDR

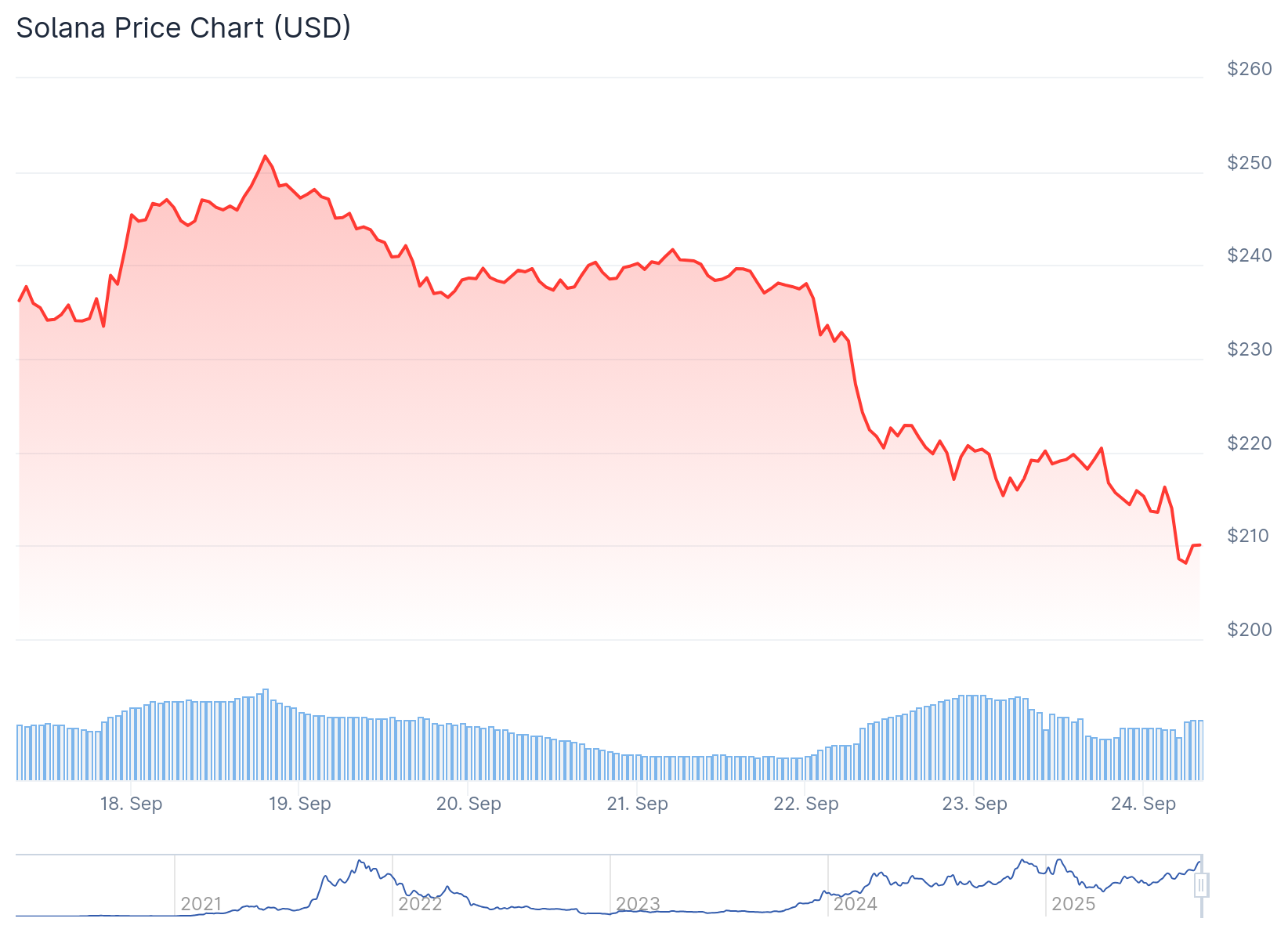

Solana price declined from $250 to test key support at $210 after falling below $220 TD Sequential indicator shows double buy signal on 4-hour chart at current support zone Price trading below 100-hourly moving average with bearish trend line resistance at $222 Rising channel pattern remains intact since August with potential targets at $250-$280 Break below $210 could lead to further decline toward $200 support zoneSolana has experienced a sharp decline from recent highs near $250, bringing the cryptocurrency to a critical juncture at the $210 support level. The price action has attracted trader attention as technical indicators suggest a potential reversal may be forming.

Solana (SOL) Price

Solana (SOL) Price

The sell-off began when SOL failed to maintain its position above the $250 zone. Bears pushed the price below key support levels at $240 and $230, eventually driving it under the psychologically important $220 mark.

The decline continued as SOL broke below the 100-hourly simple moving average. A temporary low formed at $207 before the price began consolidating its losses around current levels.

Technical analysis reveals a bearish trend line has formed with resistance positioned at $222. This level represents a key hurdle for any potential recovery attempt in the near term.

Technical Indicators Point to Potential Reversal

Despite the recent weakness, bullish signals are emerging on Solana’s charts. The TD Sequential indicator has printed a double buy signal on the 4-hour timeframe, coinciding with the approach to $210 support.

Double buy signal on $SOL from TD Sequential. Defend $210 and $250 comes next! pic.twitter.com/wRrys14sJG

— Ali (@ali_charts) September 23, 2025

This support level gains additional importance due to its confluence with the 0.618 Fibonacci retracement level. The combination creates a strong technical foundation that could halt further declines.

The rising channel pattern that has contained SOL’s price action since early August remains intact. Within this structure, the TD Sequential has registered both “9” and “13” counts in oversold territory.

These readings typically indicate trend exhaustion and potential reversal conditions. The timing of these signals at the current support zone makes the price action particularly relevant.

Should buyers successfully defend the $210 area, immediate upside targets include the $215 and $222 resistance levels. A move above $222 could trigger a larger recovery toward $230.

Support and Resistance Levels Define Next Move

The $230 level represents the 50% Fibonacci retracement of the decline from $254 to $207. A successful break above this area could set the stage for a test of $242 resistance.

Source: TradingView

Source: TradingView

Further gains might propel SOL back toward the $250 level where the recent decline originated. Breaking above $250 could extend the rally to $263 and potentially the $280-$290 Fibonacci extension zone.

However, failure to hold $210 support would compromise the bullish scenario. A breakdown below this level could expose the $202 support zone to downside pressure.

The $200 level represents major psychological support that has historically attracted buyers. A close below $200 could trigger additional selling toward the $184 support area.

Current technical indicators show mixed signals regarding immediate direction. The hourly MACD is gaining pace in bearish territory while the RSI remains below the 50 level.

Market participants are closely watching how SOL responds to the current support test. The cryptocurrency maintains its position as one of the most active Layer-1 ecosystems with growing institutional interest.

SOL is currently consolidating near $210 support with the TD Sequential double buy signal suggesting potential for a reversal if this level holds firm.

The post Solana (SOL) Price: Double Buy Signal Flashes as Token Tests $210 Support Level appeared first on CoinCentral.

1 hour ago

5

1 hour ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·