TLDRs;

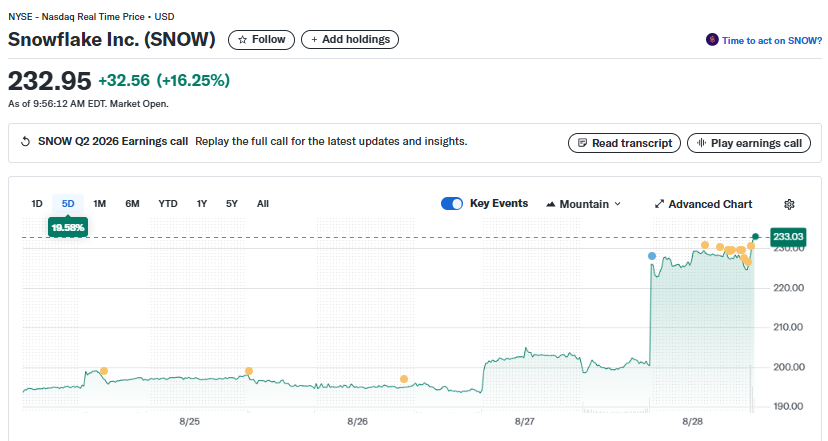

Snowflake raised fiscal 2026 product revenue guidance to $4.4B as AI demand fuels growth. SNOW stock jumped 16.25% in after-hours trading after strong Q2 results met analyst expectations. Microsoft Azure growth of 40% YoY boosted Snowflake’s EMEA expansion and global market positioning. Enterprise AI budgets shifting from pilot projects to permanent spending underpin Snowflake’s confidence.Snowflake Inc. (SNOW) surged 16.25% in after-hours trading on Wednesday after the cloud data company reported quarterly results that matched Wall Street expectations while lifting its fiscal 2026 revenue guidance.

The upbeat forecast and rising enterprise demand for artificial intelligence (AI) data solutions strengthened investor confidence, driving one of the stock’s sharpest single-day gains this year.

The company now expects fiscal 2026 product revenue to reach $4.4 billion, up from a prior forecast of $4.3 billion. The move signals Snowflake’s growing role in the AI-driven cloud infrastructure market, where enterprises are allocating larger budgets to data analytics platforms that can operate across different providers.

Snowflake Inc. (SNOW)

Snowflake Inc. (SNOW)

Cloud growth powers revenue forecast hike

For its second fiscal quarter, Snowflake posted $1.1 billion in product revenue, meeting analyst projections. The results highlighted steady customer adoption, even as the cloud computing sector faces cost pressures.

CEO Sridhar Ramaswamy credited the momentum to strong demand for Snowflake’s cloud-agnostic platform, which allows enterprises to manage and analyze data across Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

One of the standout performers was Microsoft Azure, which logged a 40% year-over-year growth rate among Snowflake’s supported clouds. Ramaswamy noted that Azure’s momentum was particularly strong across Europe, the Middle East, and Africa (EMEA), helping fuel Snowflake’s global expansion strategy.

Enterprise AI spending drives momentum

Snowflake’s forecast revision comes amid a structural shift in enterprise technology budgets. AI spending, once experimental, is now moving into permanent budget lines.

. @Snowflake is at the center of today’s enterprise AI revolution and we’re delivering on our promise to deliver customers tremendous value throughout the entire data lifecycle:

✅ 32% YoY growth, $1B+ quarterly product revenue

✅ RPO totaled $6.9B (+33% YoY)

✅ Record add in… pic.twitter.com/jSCMwggA5z

— sridhar (@RamaswmySridhar) August 27, 2025

A recent survey of 100 chief information officers (CIOs) revealed that generative AI budgets are expected to grow by 75% over the next year. Companies are transitioning from pilot projects to production-ready applications, creating sustained demand for platforms like Snowflake. Two-thirds of enterprise teams surveyed said they plan to allocate between $50 million and $250 million specifically to generative AI initiatives.

This transformation in enterprise AI spending explains why Snowflake’s leadership felt confident raising its forecast. By the end of 2024, over 70% of large enterprises are expected to have at least one generative AI project in production, embedding AI spending into core corporate strategies.

Microsoft Azure fuels global expansion

Snowflake’s close ties with multiple cloud providers have allowed it to thrive in a fragmented yet fast-growing market. While AWS remains the dominant cloud player, Azure’s rapid growth in Europe and other regions has provided Snowflake with fresh opportunities to onboard new enterprise clients.

Ramaswamy emphasized that this multi-cloud approach continues to differentiate Snowflake from competitors. By not locking enterprises into a single provider, the company has positioned itself as a flexible solution for businesses scaling AI operations across geographies.

Strong backlog underpins future confidence

Another sign of Snowflake’s strong outlook is its remaining performance obligations (RPOs) which climbed to $6.9 billion, a 33% increase from last year. This metric indicates that demand is not only growing but is locked in through long-term customer commitments.

The broader industry outlook also supports Snowflake’s bullish stance. The global cloud data warehouse market is projected to grow from $36.3 billion in 2025 to $155.7 billion by 2034, representing a compound annual growth rate (CAGR) of 17.55%. Snowflake currently maintains more than a 20% market share, alongside AWS, reinforcing its position as one of the sector’s dominant players.

The post Snowflake (SNOW) Stock Jumps 16.25% After Beating Estimates, FY26 Guidance Lifted to $4.4B appeared first on CoinCentral.

1 week ago

7

1 week ago

7

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·