TLDR

21Shares filed with the SEC to launch a SEI ETF, joining Canary Capital in the race for first SEI exchange-traded fund SEI bounced from crucial support level and could target $0.60 according to crypto analyst Michaël van de Poppe SEI currently trades at $0.30 after rising 4.2% in the last 24 hours, ranked 74th by market cap Coinbase Custody Trust Company would serve as custodian for the proposed 21Shares SEI ETF SEI is the native token of Sei Network, a layer-1 blockchain focused on trading infrastructure for decentralized exchangesAsset management firm 21Shares has filed a registration statement with the US Securities and Exchange Commission to launch an exchange-traded fund tracking SEI. The move puts the company in direct competition with Canary Capital, which submitted a similar application in April.

We're excited to announce that we've filed with the SEC for a SEI ETF in the U.S. – a key milestone in our vision to expand exchange-traded access to @Seinetwork. pic.twitter.com/nTuCLAjXyY

— 21Shares US (@21shares_us) August 28, 2025

The S-1 filing proposes using CF Benchmarks to track SEI’s price using data from multiple crypto exchanges. SEI serves as the native token for the Sei Network, a layer-1 blockchain launched in August 2023.

The Sei Network specializes in trading infrastructure for decentralized exchanges and marketplaces. Token holders can use SEI to pay network gas fees and participate in governance decisions.

Under the proposed structure, Coinbase Custody Trust Company would act as the SEI custodian. 21Shares indicated it may explore staking SEI tokens to generate additional returns for investors.

The firm noted in its filing that it continues investigating potential legal, regulatory or tax risks associated with staking. No final decision has been made on whether staking will be included in the ETF structure.

Race for First SEI ETF Approval

Currently, only Bitcoin and Ethereum have approved spot crypto ETFs in the United States. Multiple applications for other cryptocurrency ETFs remain under SEC review.

21Shares described the ETF filing as a key milestone in expanding exchange-traded access to the Sei Network. The company already operates the ARK 21Shares Bitcoin ETF alongside applications for SUI, XRP and Ondo token ETFs.

Canary Capital’s April filing proposed offering investors direct exposure to staked SEI with passive income through staking rewards. The Sei Development Foundation’s executive director Justin Barlow called ETFs a gateway for broader adoption.

SEI Price

SEI Price

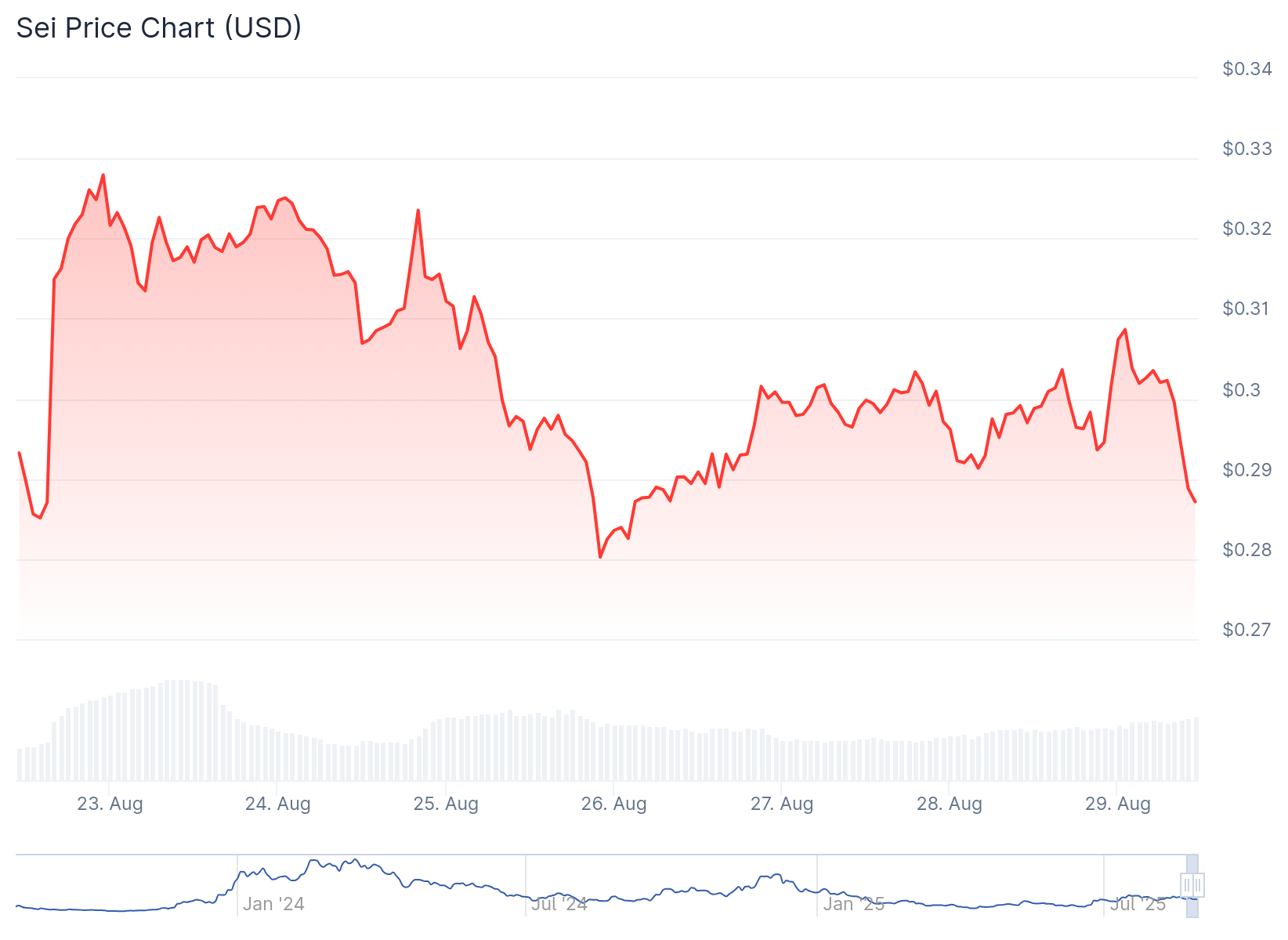

SEI currently trades at $0.30 following a 4.2% increase over the past 24 hours. CoinGecko ranks the token in 74th place by market capitalization.

Other major ETF issuers have submitted applications for various cryptocurrencies. VanEck, Bitwise and Grayscale are pursuing Solana ETFs while others target XRP, Cardano and Dogecoin.

Technical Analysis Shows Bullish Momentum

Crypto analyst Michaël van de Poppe highlighted SEI’s rebound from a crucial support level on social media. The bounce increased the probability of a strong weekly close that could maintain bullish momentum.

$SEI bounced back from a crucial support level and is likely to close a strong weekly.

Wouldn't be surprised with a run to $0.60 from here. pic.twitter.com/KGMfLjCSjb

— Michaël van de Poppe (@CryptoMichNL) August 28, 2025

Van de Poppe identified $0.60 as a potential upside target from current levels. The analyst suggested this represents a nearby level traders may monitor for continuation patterns.

The token’s recovery from support demonstrates buying pressure at key technical levels. Volume data from major exchanges showed increased activity during the bounce, indicating accumulation by investors.

SEI’s price action reflects broader altcoin strength as Bitcoin consolidates around current levels. The token’s focus on trading infrastructure aligns with growing interest in efficient blockchain solutions.

The SEC is reportedly exploring a simplified ETF approval process that would automate parts of the application review. Under the proposed system, issuers would submit standard forms and wait 75 days for automatic approval without formal objections.

The post SEI Price: Bulls Eye $0.60 Breakout as 21Shares Files ETF Application With SEC appeared first on CoinCentral.

1 week ago

5

1 week ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·