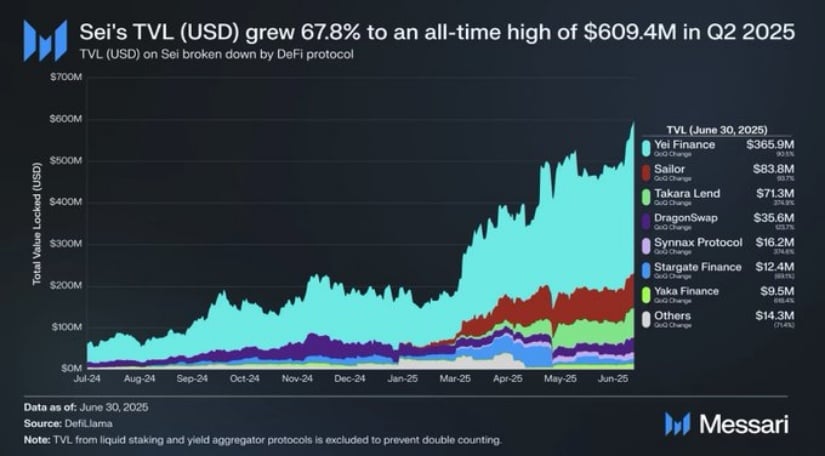

The growth was fueled by protocols like Yei Finance, Sailor, and Takara Lend, which together captured the lion’s share of liquidity inflows. As an analyst noted in a recent X post, the asset is beginning to show what “real traction” in DeFi looks like.

Capital Flows Into the Asset’s Leading Protocols

The data from Messari highlights Yei Finance as the dominant force, accounting for $365.9 million in TVL—well over half of the network’s locked value. Sailor follows with $83.8M, while Takara Lend secured $71.3M. Other notable contributors include DragonSwap ($35.6M) and Synnax Protocol ($16.2M), reflecting a growing mix of lending, trading, and staking applications driving Sei’s adoption curve.

Source: X

This broad distribution of liquidity signals a healthy ecosystem, where multiple protocols are attracting meaningful user participation rather than a single project dominating the chain. Such diversification is often viewed as a strong indicator of sustainable growth in DeFi networks.

The crypto’s performance in Q2 reinforces the analyst’s point—when infrastructure is smooth and efficient, liquidity tends to follow. With the cryptocurrency’s focus on speed and scalability, the chain has positioned itself to capture capital flows that seek efficiency in execution. The fact that TVL has doubled within months underlines the network’s momentum and strengthens its role in the next wave of DeFi expansion.

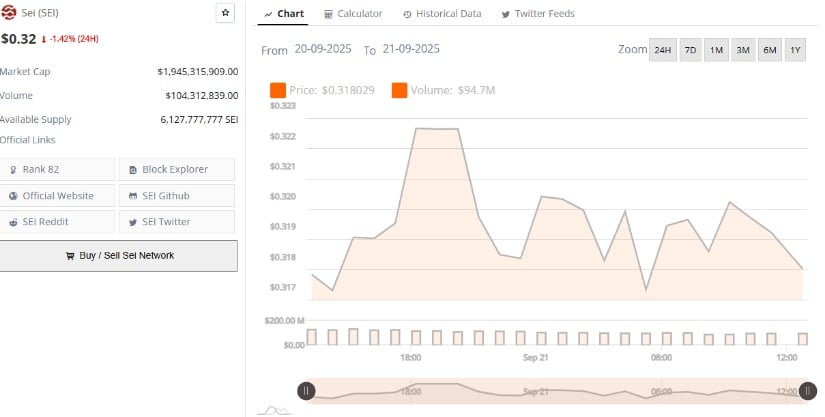

Market Data Confirms Growing Foundation

Supporting the analyst’s perspective, fresh data from BraveNewCoin underscores Sei’s solid positioning despite short-term price movement. The token is currently priced at $0.32 with a market capitalization of $1.94 billion, placing it firmly within the top 100 crypto assets at rank 82. The 24-hour volume of $104 million reflects steady market activity, even as the token slipped 1.42% on the day.

Source: BraveNewCoin

The available supply of over 6.12 billion tokens ensures broad accessibility, while liquidity remains strong enough to support the rising adoption seen in its DeFi ecosystem. When considered alongside the coins $609M in TVL, this paints a picture of an expanding network where usage is steadily translating into locked value and transactional depth.

Technical Indicators Show Triangle Pattern Eyes Breakout

At press time, the coin was trading at approximately $0.32, reflecting a period of consolidation near a critical technical level. According to the analyst known as Mister Crypto on X, there is heightened anticipation of a breakout, citing the emergence of a descending triangle formation that signals a potential surge if upper resistance is breached soon.

Mister Crypto emphasized, “$SEI BREAKOUT INCOMING!” as traders closely monitor volume spikes and momentum shifts for an imminent move.

Source: X

The price action, as mapped by the analyst and corroborated by broader technical analysis, illustrates robust market interest and renewed optimism.

If the crypto manages to surpass the upper boundary of the triangle formation, widely regarded as a bullish indicator, the token could target higher resistance levels, potentially heading toward the $1.10 region projected on the analyst’s chart. However, given ongoing volatility and recent mixed signals from moving averages, traders remain vigilant for clear confirmation before entering substantial positions.

1 hour ago

5

1 hour ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·