TLDR

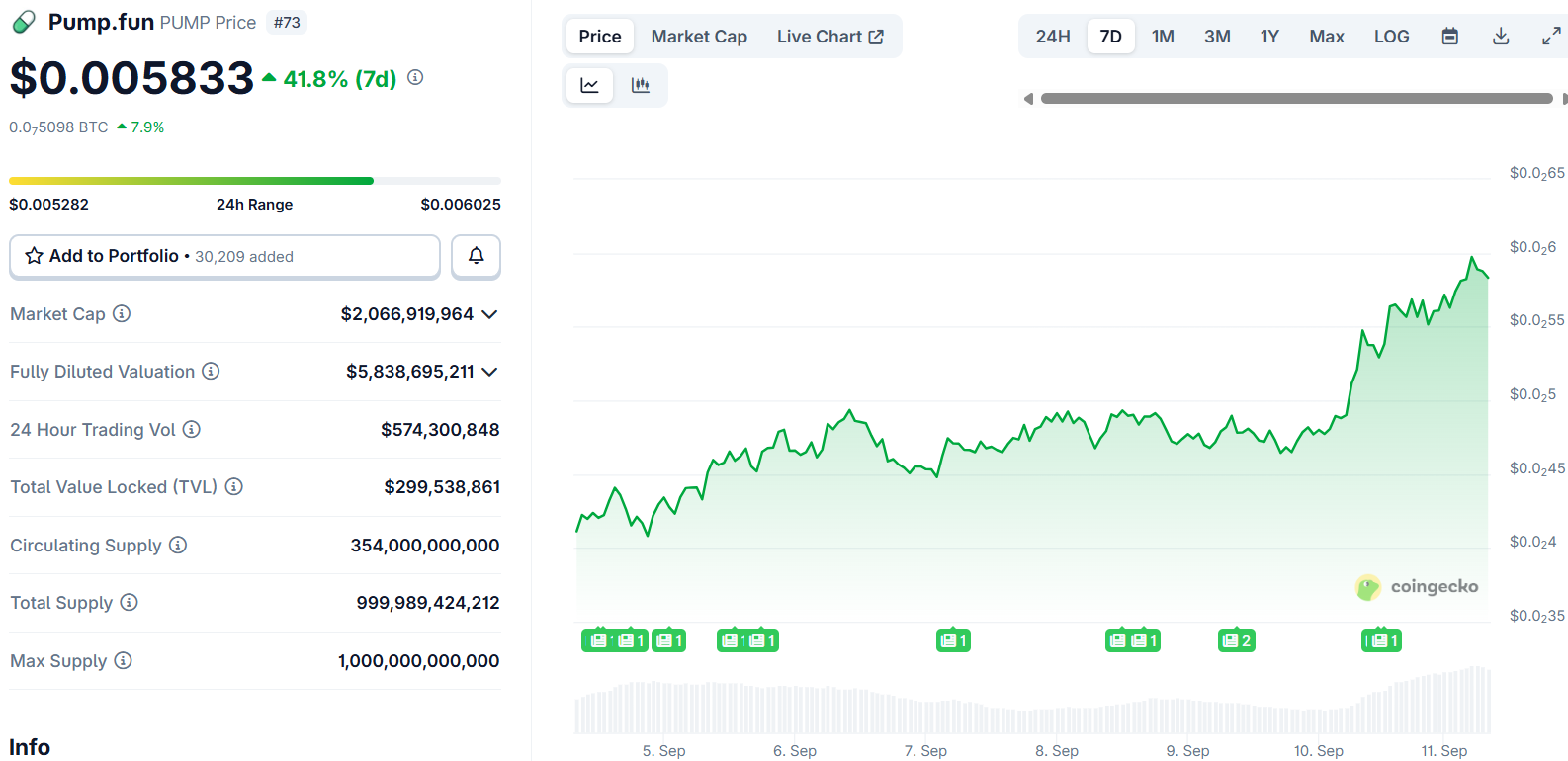

PUMP token jumped 22% to $0.0056 after Binance.US opened deposits and trading Pump.fun executed $12.2 million buyback removing tokens from circulation Platform generated $808 million lifetime revenue, ranking as top DEX by yearly revenue Open interest climbed 21.79% to $759.47 million showing increased trader participation Technical analysis points to potential $0.01 target with double bottom pattern completionPump Fun token (PUMP) emerged as Tuesday’s top cryptocurrency performer with a 22% surge to $0.0056. The rally pushed market capitalization near $2 billion while trading volumes exploded 130% to $443 million.

Pump.Fun (PUMP) Price

Pump.Fun (PUMP) Price

The primary catalyst came from Binance.US opening PUMP deposits on September 9. Trading against USDT went live the following day on the major U.S. exchange platform.

Binance.US serves as the American branch of Binance, the world’s largest cryptocurrency exchange by volume. The listing provides PUMP with access to a broader investor base.

Deposits for $PUMP are now open on https://t.co/AZwoBOgsqS!

Trading on the PUMP/USDT pair will begin on Sep 10 at 7 a.m. EDT.@pumpdotfun is a popular Solana-native launchpad that lets anyone create a token and trade it instantly via an automated bonding-curve market.

— Binance.US 🇺🇸 (@BinanceUS) September 9, 2025

The token completed a double rounded bottom formation that began developing in mid-August. Price action broke above the $0.00499 resistance level, which now functions as support.

Technical indicators show strong buy signals across oscillators and moving averages. The RSI reading of 73 suggests momentum remains strong without reaching extreme levels.

Buyback Strategy Drives Scarcity

Pump.fun’s aggressive buyback program removed $12.2 million worth of tokens from circulation. The platform has repurchased over $84 million in tokens since launch two months ago.

$PUMP buybacks still going strong

They did $2.5m worth yesterday, more than their revenue lol

You can just tail these buys and make money but you wouldn't believe it pic.twitter.com/WM1KuZbGfO

— Reetika (@ReetikaTrades) September 10, 2025

This strategy reduced circulating supply by 6.11% while creating upward price pressure. The buybacks occur daily as part of the platform’s revenue distribution model.

Open interest jumped 21.79% to $759.47 million according to CoinGlass data. The increase reflects growing speculative participation from derivatives traders.

Rising open interest combined with supply reduction creates conditions favorable for continued price appreciation. The mechanics support higher volatility in both directions.

Revenue Growth Powers Token Economics

Pump.fun generated $808 million in lifetime revenue according to Token Terminal data. This figure surpasses established platforms like PancakeSwap and Raydium.

The protocol ranks as the top decentralized exchange by revenue over the past twelve months. Daily revenue flows fund the ongoing buyback operations.

Platform distributed $15.5 million in creator fees during a recent seven-day period. This activity demonstrates Pump.fun’s position as one of Solana’s most active decentralized applications.

Mike Dudas noted the platform holds over $2 billion in cash reserves. These funds target reinvestment into creator growth initiatives that support token demand.

Lazul Capital identified PUMP as the second-largest revenue-producing protocol in cryptocurrency. Only stablecoin issuers like Tether and Circle generate higher revenues.

Source: TradingView

Source: TradingView

The next resistance level sits at $0.00677 where PUMP faced previous rejection. A break above this zone would confirm bullish continuation toward higher targets.

Support exists around $0.0047 and $0.00454 for any potential pullbacks. The technical structure suggests these levels would attract buying interest.

Current price action shows the token trading near $0.00556 with momentum indicators supporting further gains. The projected upside from the breakout pattern approaches 80% if resistance breaks.

The post Pump Fun (PUMP) Price: Soars 22% Following Binance Listing and Major Buyback Program appeared first on CoinCentral.

7 hours ago

2

7 hours ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·