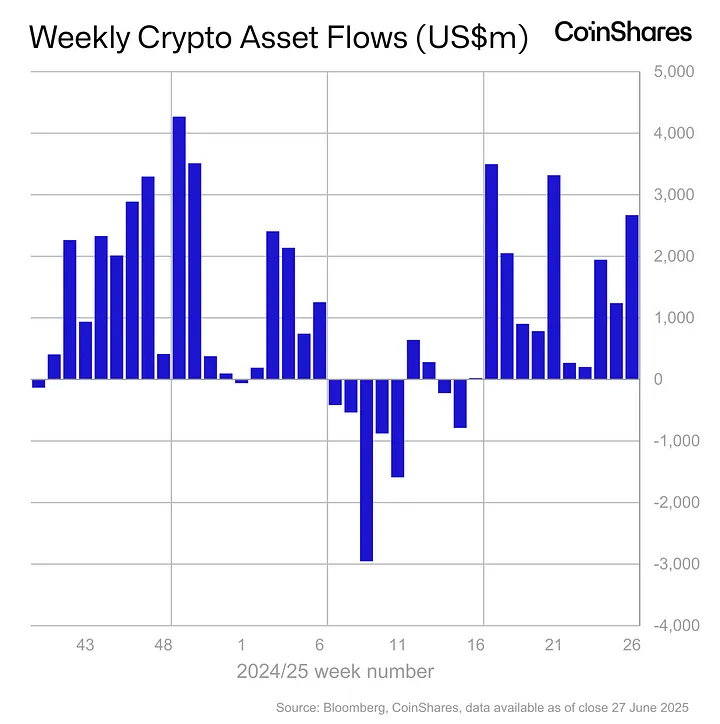

That’s now 11 straight weeks of positive inflows, pushing 2025’s total to nearly $18 billion — a pace not seen since the explosive ETF debut phase in early 2024.

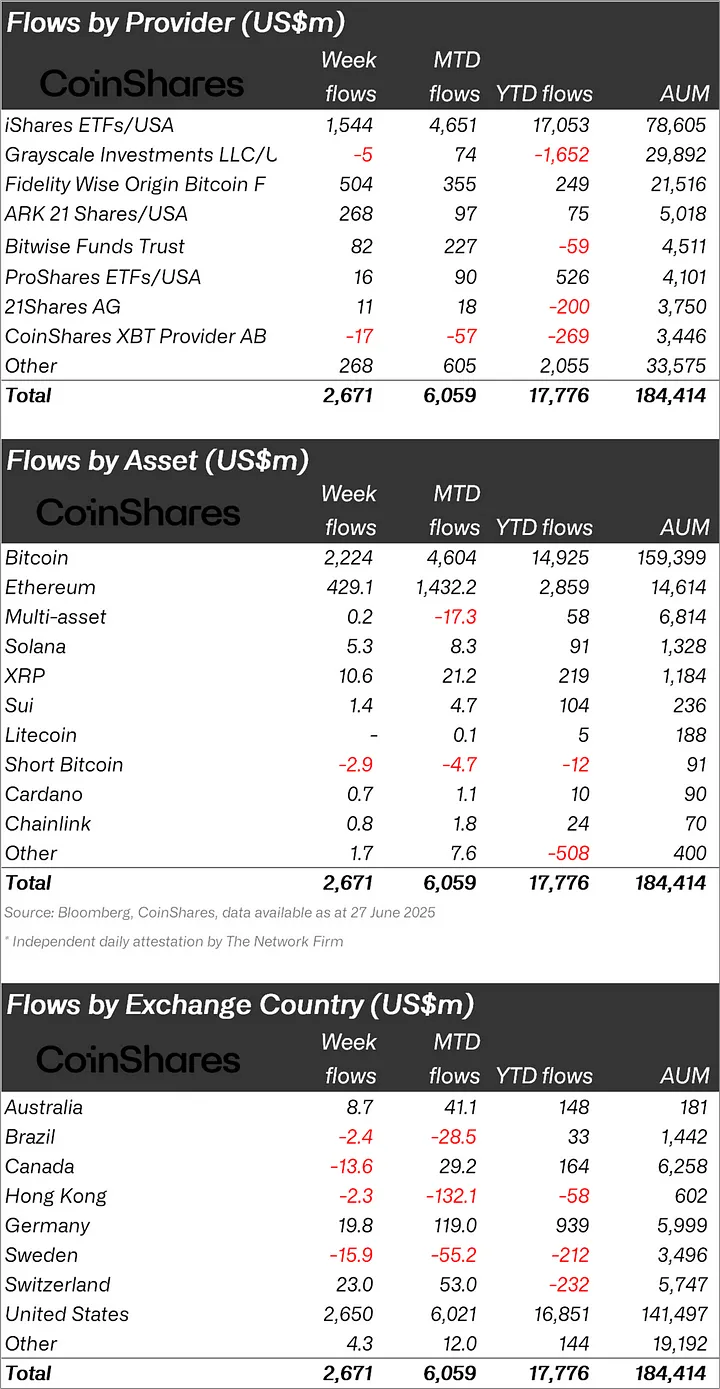

According to data tracked by CoinShares, digital asset funds worldwide have reached $184.4 billion in assets under management, with investor demand showing no signs of slowing. Analysts point to rising geopolitical tensions and uncertainty around central bank policy as key drivers behind the renewed appetite for crypto exposure.

Bitcoin remains the top magnet for capital, drawing in $2.2 billion last week. On the flip side, bearish BTC funds saw continued outflows, adding to a growing trend that reflects waning interest in shorting the market.

Ethereum-based products also maintained momentum, pulling in $429 million and logging their longest inflow streak since 2021. While U.S.-based Ethereum ETFs took the lion’s share of that amount, they still trailed the dominance of Bitcoin spot ETFs in terms of volume.

Regionally, the U.S. continues to lead by a wide margin, with European funds in Switzerland and Germany showing mild gains. Meanwhile, Canada, Brazil, and Hong Kong posted modest outflows, slightly tempering the global total.

Crypto investment products appear to be regaining their shine as investors look for alternatives in an increasingly unstable macro environment — and with ETF flows heating up again, the second half of the year could bring even stronger momentum.

The post Investors Pour Billions Into Crypto for 11th Straight Week appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·