The 10-day and long-term charts indicate a key supply zone near $0.00030–$0.00050 that could trigger a major breakout. Meanwhile, the asset trades around $0.00008298 after a 2.75% daily dip, as buyers look to defend critical support levels.

Long-Term Rising Trend Supports Accumulation

Analyst EᴛʜᴇʀNᴀꜱʏᴏɴᴀL reports that the token continues to respect a long-term ascending support line established in 2022. The 10-day chart indicates that each decline since then has formed a consolidation wedge before the next move upward. This recurring structure shows buyers repeatedly defending higher lows, laying a steady technical base.

FLOKIUSD Chart | Source:x

Moreover, the chart projects a stair-step climb toward 2026. As long as the price holds above the rising trendline, this steady upward path suggests the token could maintain momentum into the next market cycle. Market participants are closely watching for a decisive close above the upper consolidation boundary to confirm the start of a new upward leg.

Key Supply Zone Near 2021 Highs

The cryptocurrency remains below a major supply zone around 0.00030–0.00050 USD, an area that acted as strong resistance during 2021. This region represents the next critical level where bulls must demonstrate strength for a breakout. Historical activity shows that reaching this area typically attracts heavy selling, making it an important target.

According to the analyst, a successful breakout and close above this band would provide technical validation for an extended rally. The chart outlines a gradual approach to this zone with multiple advances and minor pullbacks, reinforcing the potential for an eventual challenge of the 2021 peak.

Additional Perspective from Crypto Peer

Analyst Crypto Peer  shares a similar long-term view as analyst EᴛʜᴇʀNᴀꜱʏᴏɴᴀ. His chart shows FLOKI firmly inside a rising trend channel that began in 2022, with price consistently creating higher lows and holding above the main ascending support. The persistence of this slope through different market conditions suggests ongoing accumulation.

shares a similar long-term view as analyst EᴛʜᴇʀNᴀꜱʏᴏɴᴀ. His chart shows FLOKI firmly inside a rising trend channel that began in 2022, with price consistently creating higher lows and holding above the main ascending support. The persistence of this slope through different market conditions suggests ongoing accumulation.

Crypto Peer also identifies the same broad supply area near the 2021 highs as a key focus. He notes that a breakout above the current consolidation wedge could set the stage for a major advance, provided the ascending base remains intact. A retest and confirmation above the supply zone could pave the way for further price expansion into 2026.

Current Market Data and Near-Term Movement

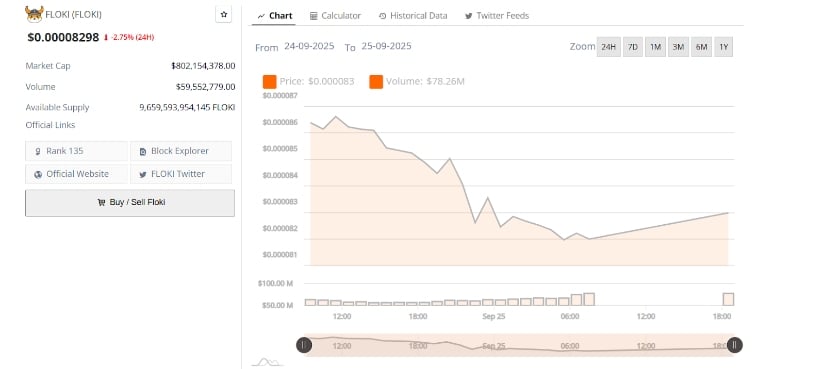

On the 24-hour chart, the asset traded lower despite the long-term bullish setup. The token opened near $0.000086 and fell to an intraday low around $0.000081, before recovering slightly to $0.00008298. This marks a 2.75% daily decline, with market capitalization around $802 million and a circulating supply of about 9.65 trillion tokens.

FLOKIUSD 24-Hr Chart | Source: BraveNewCoin

Trading volume dropped to $59.55 million, down from a recent high of about $78.26 million. The late-session rebound indicates some buyers are attempting to secure short-term support, but the near-term trend remains cautious until new higher lows form. While daily momentum shows pressure, the broader rising trend still signals potential for a larger rally if key support holds.

1 hour ago

2

1 hour ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·