Analysts suggest that today’s price action could define Ethereum’s short-term trajectory, setting the stage for a potential historic rally toward $11,000.

Ethereum Price Outlook Today

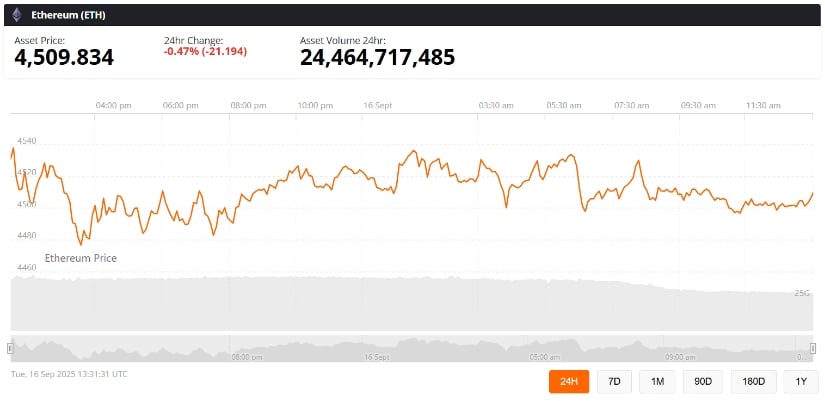

According to Brave New Coin, the current ETH price is $4,509, down 0.47% in the past 24 hours, with a trading volume of more than $24.4 billion. This slight dip comes as Ethereum consolidates near the $4,500 zone, a level analysts see as a crucial pivot point.

Ethereum (ETH) was trading at around $4,509, down 0.47% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Holding this area could set the stage for another push toward the $4,600–$4,800 resistance range. A clean breakout above that barrier may pave the way for Ethereum’s next major rally attempt, reinforcing the bullish outlook despite short-term fluctuations.

Key Technical Levels in Play

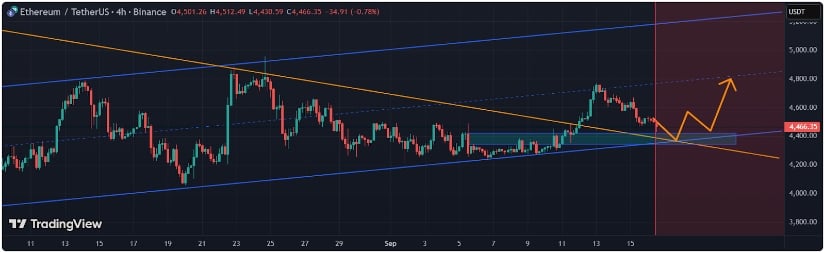

From a technical perspective, Ethereum is consolidating around the $4,500 level. The asset has repeatedly tested resistance near the $4,600 to $4,800 range, but a decisive breakout has yet to materialize. Bulls are watching for a close above this barrier to confirm momentum toward the $5,000 mark and beyond.

ETH rebounds above $4,400, showing bullish momentum and eyeing $4,750–$5,000 resistance. Source: RTED_Investing on TradingView

Support levels are equally important. The $4,400 zone remains a critical floor, with deeper supports forming below $4,300. While the current structure suggests consolidation, breaking resistance could ignite a sharp rally, whereas failure to hold support may lead to short-term pullbacks.

Institutional Demand Accelerates Ethereum’s Bullish Outlook

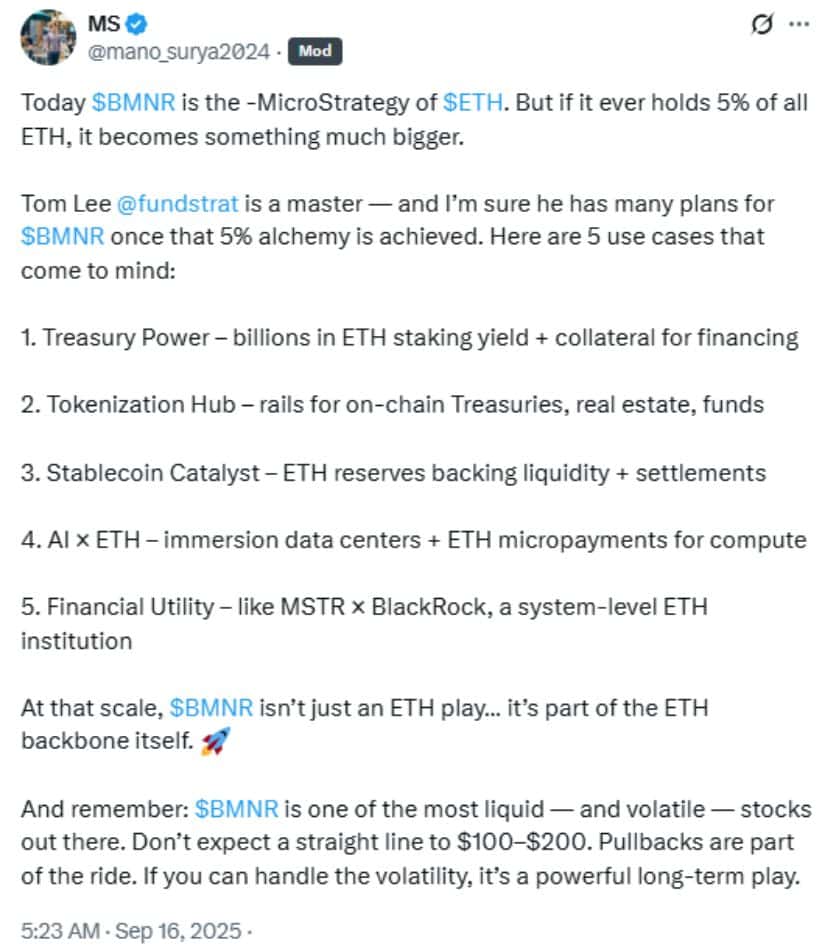

Ethereum is experiencing a significant surge in institutional accumulation, potentially reshaping its price trajectory. Notably, BitMine Immersion Technologies has become the world’s largest publicly traded holder of ETH, with over 2.15 million ETH, valued at approximately $9.97 billion at current prices. This aggressive accumulation strategy aligns with BitMine’s goal to acquire 5% of ETH’s total supply, a vision referred to as the “Alchemy of 5%.”

BMNR could become a core part of Ethereum’s ecosystem, unlocking treasury, DeFi, AI, and financial utilities once it hits 5% of total ETH. Source: @mano_surya2024 via X

In parallel, Ethereum exchange-traded funds (ETFs) are drawing substantial inflows. Between September 8–12, 2025, Ethereum ETFs saw $638 million in net inflows, with some of the largest funds contributing significant amounts. This marks the fourth consecutive week of gains, pushing cumulative Ethereum ETF inflows above $13.3 billion. These developments underscore Ethereum’s growing role as an institutional-grade digital asset, attracting significant attention from both corporate treasuries and investment funds.

Staking and Network Activity Build Strength

On-chain data further supports the bullish narrative. More than 28 million ETH is now staked, reducing liquid supply and signaling confidence from long-term holders. This steady growth in staking has become a cornerstone of Ethereum’s investment case, ensuring that large amounts of ETH remain locked within the network.

In parallel, network activity is expanding, with higher transaction counts and stronger usage of decentralized applications. These fundamentals highlight Ethereum’s continued relevance as the backbone of decentralized finance (DeFi), stablecoin settlement, and tokenization markets.

Path Toward $11,000: Ethereum Price Prediction 2025 Outlook

Analysts see a potential path for Ethereum to reach $11,000 if institutional demand, ETF inflows, and on-chain activity continue to strengthen. Historically, when ETH has broken major psychological resistance levels, rapid gains have often followed—a pattern that appears to be forming once again. Reduced exchange supply, growing institutional allocations, and staking-driven scarcity further support the bullish case, echoing previous cycles where Ethereum quickly outpaced expectations.

ETH nears final resistance—breakout could ignite a historic rally toward $11K. Source: @MerlijnTrader via X

Looking ahead, Ethereum’s 2025 price prediction remains optimistic but comes with caution. Currently trading around $4,500, ETH faces resistance between $4,800 and $5,000, while support holds near $4,400. These levels are pivotal for shaping its medium-term trajectory. If ETH can clear resistance, a surge toward higher targets is possible; however, failure to maintain support or shifts in broader market conditions could delay the rally.

2 hours ago

5

2 hours ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·