TLDR

YZi Labs (Changpeng Zhao’s firm) has increased its investment in Ethena Labs, the company behind USDe stablecoin The funding will help expand USDe adoption across BNB Chain and support development of USDtb stablecoin and Converge settlement layer USDe has reached $13-14 billion market cap, making it the third-largest stablecoin after USDT and USDC YZi first invested in Ethena in February 2024 through its incubation program before USDe’s public launch USDe uses a delta-neutral hedging strategy backed by cryptocurrencies to maintain its $1 pegYZi Labs, the venture capital firm led by former Binance CEO Changpeng Zhao, has expanded its investment in Ethena Labs. The company creates USDe, which has become the third-largest stablecoin by market value.

The new funding will help Ethena expand USDe adoption across centralized and decentralized platforms. YZi Labs stated the investment supports its mission to build scalable digital dollar infrastructure for the financial ecosystem.

— YZi Labs (@yzilabs) September 19, 2025

Ethena CEO Guy Young said the goal has always been embedding stable, yield-bearing assets into the crypto economy. He noted that USDe is now scaling across exchanges, DeFi protocols, and global user bases.

YZi Labs first invested in Ethena through its Season 6 Incubation Program in February 2024. This happened before USDe launched to the public. The firm was formerly known as Binance Labs.

USDe operates as a synthetic dollar backed mainly by cryptocurrencies. The stablecoin maintains its $1 peg through a delta-neutral hedging strategy that balances risk across positions.

Growth Across Multiple Platforms

The funding will support USDe expansion on BNB Chain following its April 2025 deployment. New money markets, protocol integrations, and ecosystem partnerships are already underway on the network.

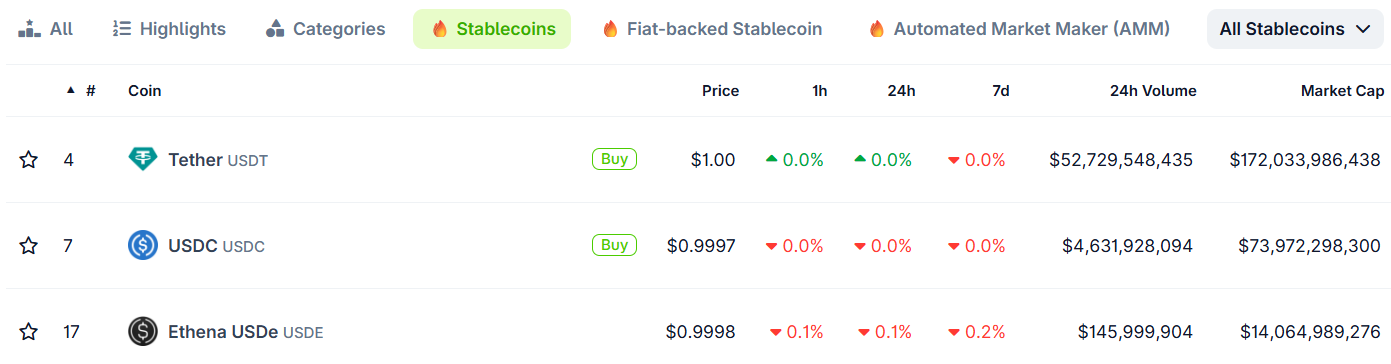

USDe has grown rapidly since launch, reaching over $13 billion in supply according to Ethena data. CoinGecko shows the stablecoin has achieved a $14 billion market cap.

CoinGecko

CoinGecko

This makes USDe the third-largest stablecoin after Tether’s USDT at $171.5 billion and Circle’s USDC at $73.9 billion. The growth represents one of the fastest climbs to $10 billion for any stablecoin.

Ethena’s total value locked now exceeds $13 billion across various DeFi applications and centralized exchanges. The protocol has integrated with leading platforms in the decentralized finance space.

New Products in Development

The investment will help fund development of USDtb, a new stablecoin backed by short-duration treasury assets. This includes exposure to BlackRock’s BUIDL fund, which invests in US Treasury securities.

Ethena is also building Converge, an institutional settlement layer compatible with Ethereum Virtual Machine. The platform focuses on tokenizing real-world assets for institutional use.

YZi Labs manages $10 billion in assets across crypto, artificial intelligence, and healthcare sectors. The firm recently promoted Aster, a decentralized perpetuals exchange that plans to integrate USDe.

Ethena has attracted investment from major financial firms including Fidelity and Franklin Templeton. Crypto venture capital firm DragonFly also backs the stablecoin issuer.

The US Treasury estimated the $295 billion stablecoin market could reach $2 trillion by 2028. President Trump signed the GENIUS Act in July, creating comprehensive stablecoin regulations.

USDe’s expansion comes as stablecoins gain broader acceptance in traditional finance and regulatory frameworks. The synthetic dollar model offers an alternative to bank-backed stablecoins through its crypto-collateralized approach.

The post CZ’s YZi Labs Expands Investment in Ethena Labs for USDe Stablecoin Growth appeared first on CoinCentral.

1 hour ago

2

1 hour ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·