The Chicago Mercantile Exchange Group (CME), the world’s largest derivatives platform, is set to broaden its cryptocurrency derivatives offerings with the addition of options on Solana (SOL) and XRP futures, starting October 13. This expansion follows a surge in trading activity of Solana and XRP futures contracts since their launch earlier this year, reflecting growing market interest in these digital assets.

The new options contracts will provide traders with the ability to hedge or speculate on SOL and XRP futures through standard and micro-sized contracts, with expiries available on a daily, monthly, and quarterly basis. These derivative products are pending regulatory approval, emphasizing the ongoing evolution of the regulated crypto market.

Giovanni Vicioso, CME’s global head of cryptocurrency products, highlighted that the move underscores “significant growth and increasing liquidity” in crypto futures markets. He anticipates these offerings will attract a diverse range of participants, from institutional investors to active individual traders.

Since their respective launches, Solana futures have seen over 540,000 contracts traded, representing approximately $22.3 billion in notional value, with August setting a record of 9,000 contracts traded daily. XRP futures, initiated in May, have garnered more than 370,000 contracts traded, totaling about $16.2 billion in notional value, with record open interest reaching nearly $942 million in August.

Altcoin futures gain prominence in US markets

The expansion of regulated crypto derivatives in the US began with the introduction of Bitcoin futures by the Chicago Board Options Exchange (Cboe) and CME Group in December 2017, under oversight from the Commodity Futures Trading Commission (CFTC). This paved the way for subsequent launches, including Ether futures in 2021 and micro contracts at 0.1 ETH, aiming to meet rising demand for regulated derivatives in a market still largely dominated by Bitcoin and Ether.

Policy clarity from measures like the Genius Act and a pro-crypto White House has further fueled demand, prompting traditional exchanges and US-based crypto platforms to expand their derivative offerings.

Notably, Coinbase launched Solana futures contracts, including nano-sized options, in the US and has announced the acquisition of Deribit, a major options exchange. Meanwhile, Kraken established its derivatives division, and Robinhood introduced micro futures on Bitcoin, Solana, and XRP, reflecting the increasing institutional and retail interest in regulated crypto derivatives.

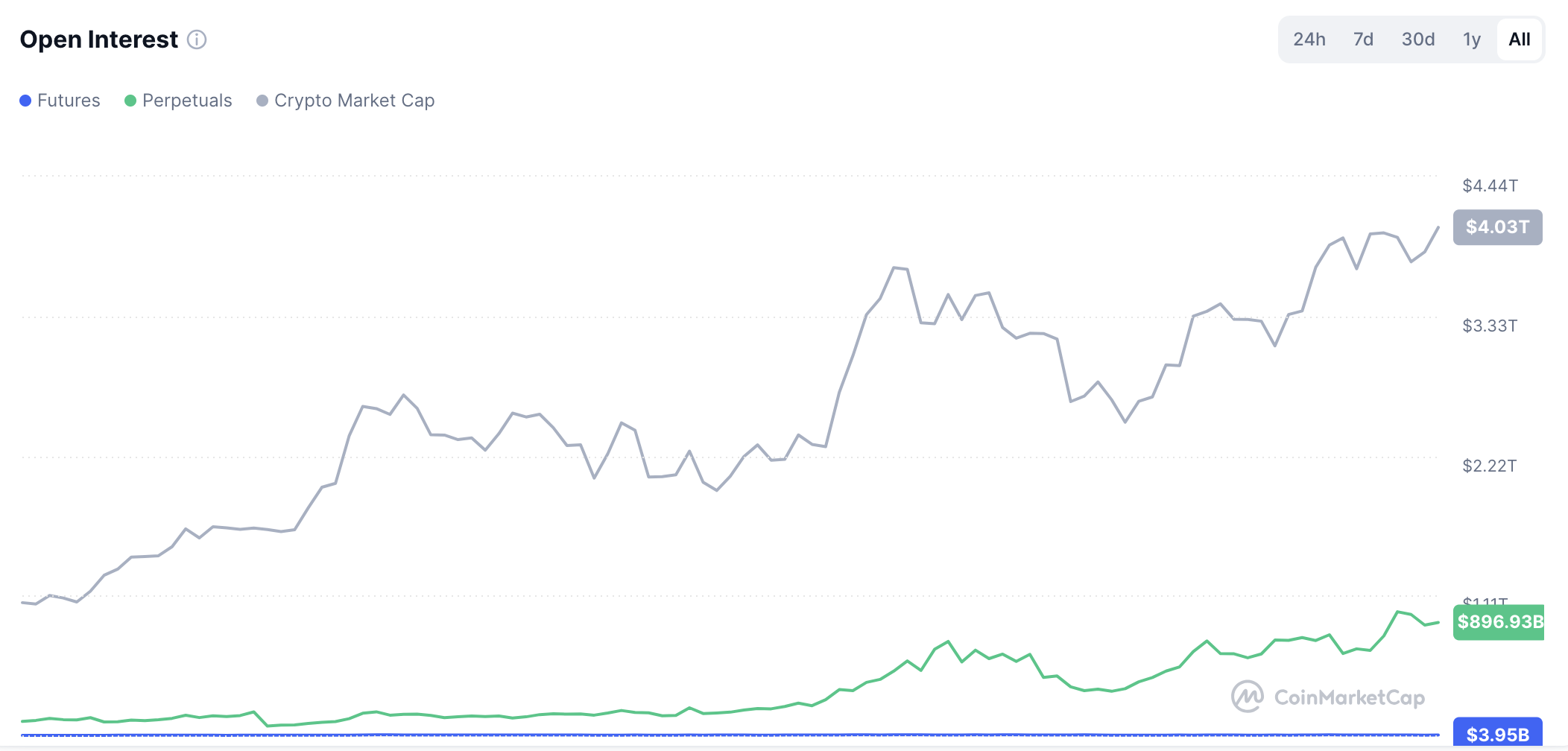

Open interest across crypto futures and perpetual contracts. Source: CoinMarketCap

Open interest across crypto futures and perpetual contracts. Source: CoinMarketCap

Despite the increasing regulatory acceptance, the worldwide open interest in crypto derivatives remains substantial, hovering near $4 billion, indicating sustained investor interest across markets.

This article was originally published as CME Launches Solana and XRP Options as US Crypto Derivatives Boom on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

1 hour ago

1

1 hour ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·