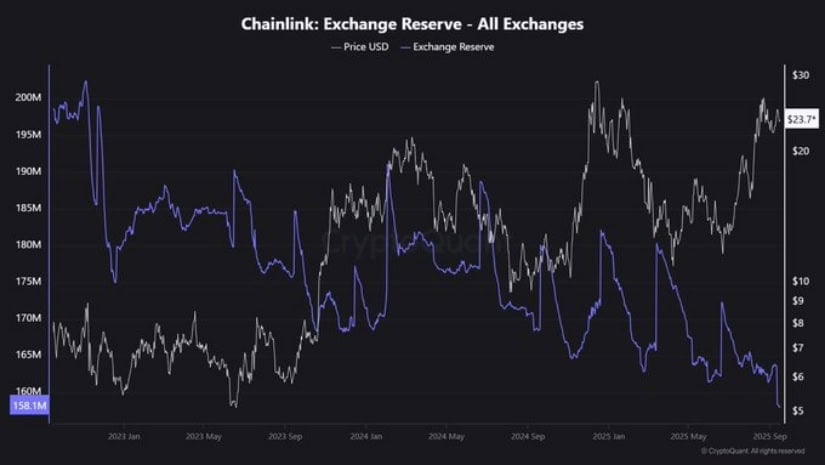

A steady reduction in tokens held on exchanges, down from nearly 200M in 2023 to about 158M in September 2025, highlights ongoing accumulation and reduced selling pressure. Historically, such supply trends have aligned with bullish price momentum, suggesting the asset could be preparing for another leg higher.

Exchange Reserves Signal Accumulation

In recent months, LINK’s exchange balances have continued to decline even as its price has rallied past $23.7. This divergence between falling supply and rising value underscores a bullish backdrop where scarcity strengthens buying momentum. Past cycles show that major drops in reserves have often preceded sharp rallies, and the current setup appears to be following the same script.

Source: X

The most recent climb through $20 and toward $24 reflects renewed market demand against a backdrop of dwindling liquidity on centralized platforms. With fewer tokens available for immediate sale, upward pressure could intensify if buying interest continues to grow. Traders view this as a sign that long-term holders are locking tokens away, reducing the likelihood of large sell-offs.

This supply squeeze narrative is further supported by increasing institutional adoption of the crypto’s technology, which boosts confidence in its role within blockchain infrastructure. Together, demand growth and reduced supply provide a foundation for sustained bullish momentum, keeping the cryptocurrency firmly in focus for both short- and long-term investors.

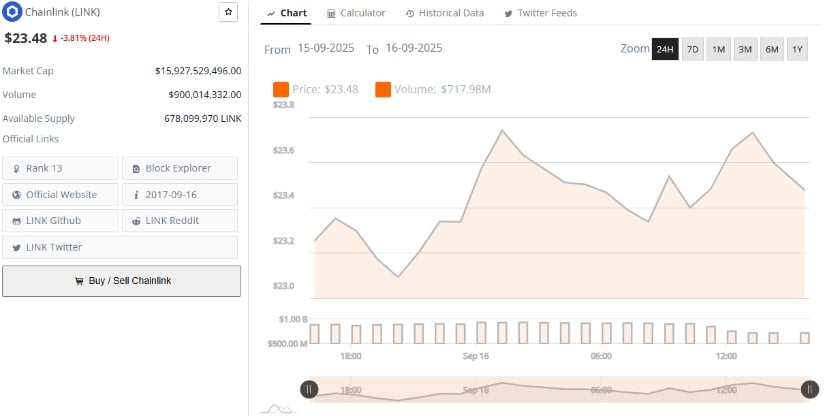

Market Metrics Highlight Stability Around Key Support

According to recent market data, LINK trades at $23.48, down 3.81% in the last 24 hours. Despite the pullback, its market capitalization of $15.92 billion secures its position within the top 15 cryptocurrencies. Daily trading volume remains strong at over $900 million, reinforcing healthy liquidity and active participation across global markets.

Source: BraveNewCoin

Intraday activity shows the coin fluctuating between $22.6 and $24.0, consolidating after recent gains. This range-bound movement suggests a pause as the market absorbs profit-taking while buyers defend support levels. The available supply of 678 million tokens continues to circulate actively, but shrinking exchange balances highlight tightening conditions that could magnify volatility.

Technical Indicators Show Mixed Sentiment

At press time, LINK was trading at $23.55, edging slightly lower by 0.04%. The token has eased from recent highs near $27.87, but remains well above its mid-2025 lows around $10.10.

This sharp appreciation highlights a strong uptrend, though current price action reflects consolidation around the $23 area. The horizontal support at $19.53 remains a key level to watch in the event of further downside.

Source: TradingView

The Chaikin Money Flow (CMF) stands at -0.04, suggesting mild capital outflow despite price stability. This signals cautious sentiment among traders, with slightly more money leaving than entering over the past sessions. If selling pressure persists, the asset could face short-term headwinds, though broader demand trends still support the long-term case.

2 hours ago

5

2 hours ago

5

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·