Cardano price is starting to build momentum, breaking past the $0.93 barrier that had kept it in check for days. Buyers are stepping in with stronger conviction, defending the uptrend and pressing against the next resistance at $0.95. The big question now is, can ADA Cardano price turn this into a clean breakout towards $1.00, or will fresh whale activity test just how strong the rally really is?

Cardano Price Starting to Break Higher

Cardano price has cleared the $0.93 mark, breaking through a resistance level that has capped its progress in recent days. The daily chart shows ADA holding firmly along an ascending trendline, with higher lows steadily building momentum since early August. Volume spikes on green candles suggest that buyers are stepping in on dips, reinforcing the bullish structure. As long as this trendline remains intact, the market continues to show constructive signals pointing towards further upside.

Cardano’s ADA breaks past $0.93 resistance, with momentum now building toward the key $0.95 zone. Source: Mr Banana via X

Analyst Mr Banana highlights that the breakout leaves ADA eyeing the next immediate zone near $0.95. A decisive move through this level could set the stage for a run towards $1.00 and beyond, turning psychological resistance into a major battleground. With RSI still in mid-range territory and no signs of overextension, the current setup keeps the bullish Cardano Price Prediction alive, provided the trendline support continues to hold firm.

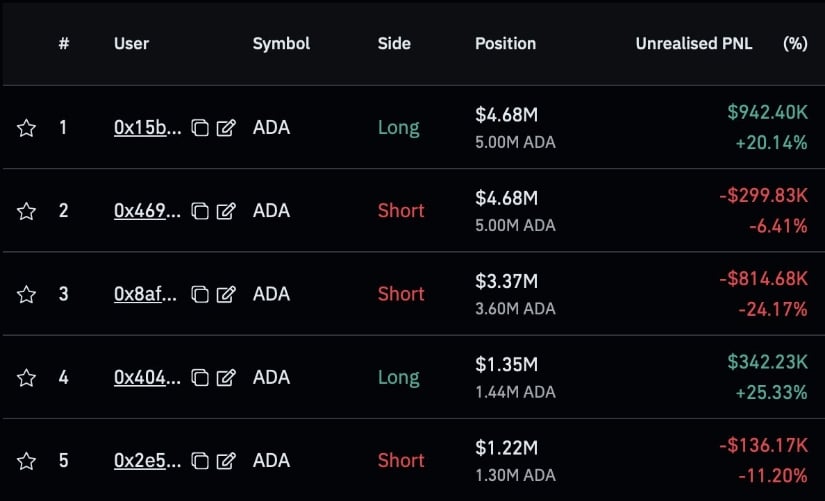

ADA Cardano Longs Dominate as Shorts Take Heavy Losses

Fresh data from TapTools shows ADA Cardano longs firmly in control, with the largest $4.68M long position now sitting nearly $1M in profit, up more than 20%. Another notable $1.35M long is also riding gains of over 25%. In sharp contrast, shorts have been hit hard, with positions down between -6% and -24%, translating into losses of hundreds of thousands. This shift in positioning highlights the strong conviction backing ADA’s recent breakout above $0.93.

Cardano traders are leaning heavily bullish, with long positions booking big profits while shorts suffer steep losses after ADA’s breakout above $0.93. Source: TapTools via X

The aggressive short losses add further weight to the bullish structure. With buyers successfully forcing shorts to cover, the market dynamic continues to tilt in favor of the bulls. If this imbalance persists, it could provide the extra fuel needed to push Cardano towards the $0.95 zone and beyond.

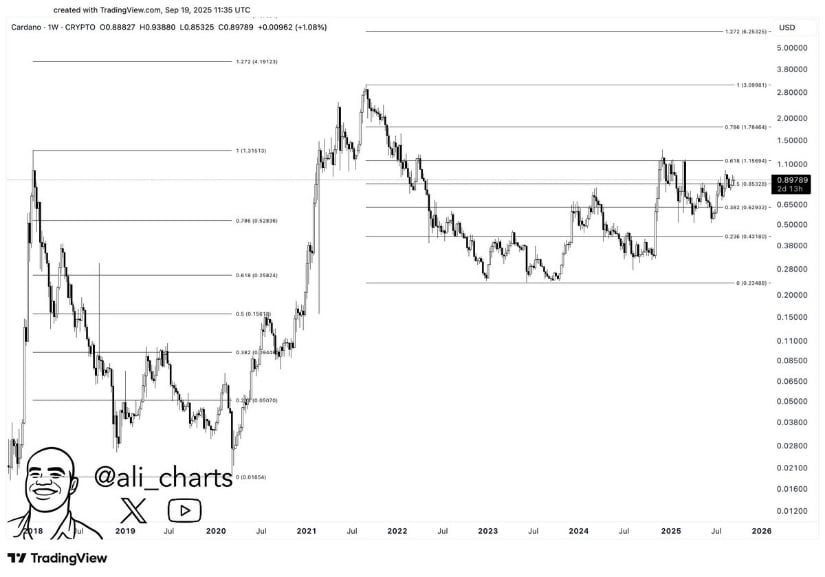

Cardano Price Prediction: Fibonacci Levels Point to $3–$6 Range

Cardano’s long-term chart is showing familiar behavior when mapped against Fibonacci extensions. In the last cycle, ADA topped out at the 1.272 Fib, and according to analyst Ali Martinez, the current structure is once again moving in line with similar proportions. Price is now holding near the $0.88 to $0.93 range, which sits just above the 0.236 retracement, suggesting that Cardano price is in the early stages of its next major expansion phase.

Cardano’s long-term Fibonacci setup suggests a possible rally into the $3–$6 range. Source: Ali Martinez via X

Ali projects that this cycle could see Cardano extend into the $3 to $6 range if historical Fib behavior repeats. This would align with the bullish conviction highlighted by TapTools data, where long positions continue to dominate despite heavy short losses. As long as ADA sustains higher lows and respects its key support zones, the Cardano Price Prediction is likely to play out.

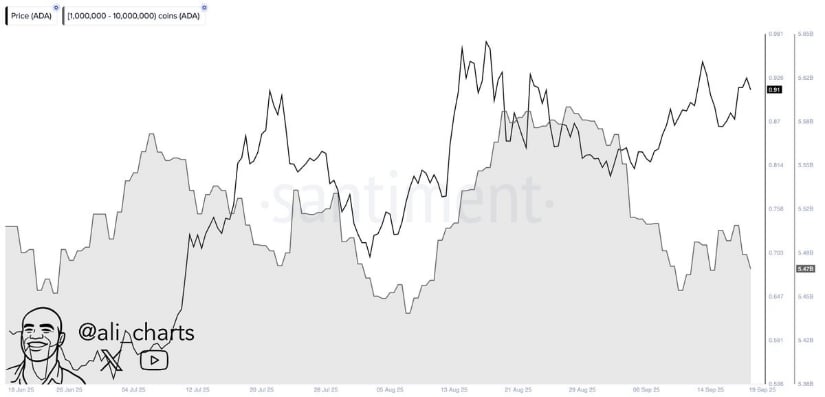

Cautious Outlook: Whale Selling Tests ADA’s Resilience

Despite multiple bullish catalysts appearing, Cardano price now faces a major cautious development as fresh data from analyst Ali shows whales have sold nearly 530 million ADA in the past 48 hours. Such large-scale distribution often signals near-term pressure, especially coming right after ADA’s breakout above the $0.93 level. This selling wave puts the strength of the breakout to the test, raising the question of how effectively demand can absorb the increased supply entering the market.

Whales offload 530M ADA in just 48 hours, testing the strength of Cardano’s breakout above $0.93. Source: Ali Martinez via X

Even so, the broader technical picture highlighted in earlier setups remains constructive, with ADA continuing to respect its ascending trendline support. While whale activity could slow momentum in the short term, holding these structural levels would reinforce the resilience behind Cardano’s recent move higher. If buyers step in to absorb this selling pressure, the Cardano Price Prediction path toward $1.00 and longer-term Fibonacci targets in the $3 to $6 range stays intact.

Final Thoughts: Breakout or Correction?

Cardano’s latest breakout above $0.93 has brought fresh excitement, but the heavy whale selling shows the market isn’t without risks. Traders will be watching closely to see if buyers can continue defending the ascending trendline and absorb the new supply hitting the market. Holding above $0.93 keeps momentum in the bulls’ favor, while reclaiming $0.95 could set the tone for the push toward $1.00.

At the same time, failure to hold these levels could turn the breakout into a short-lived move, forcing Cardano price back into its earlier range. With strong long positions riding gains and shorts already taking losses, the pressure remains tilted towards the upside.

2 hours ago

4

2 hours ago

4

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·