The daily candle closed at $952.89, marking a 3.60% gain in 24 hours with an intraday peak of $955.50. Moving averages show continued strength: the 7-day sits at $922.01, the 25-day at $878.79, and the 99-day at $766.32, confirming a long-term uptrend.

Analysts attribute steady accumulation from the $601.25 support level and robust institutional demand as key drivers. Trading volume near $1.95 billion and a market cap of $133.1 billion signal investor confidence. Experts now watch the $1,000 psychological level as the next major resistance, with support holding around $900–$920 critical for sustaining the rally.

Strong Price Action and Technical Indicators

Analysts reported that Binance coin is trading above its 7-day moving average of $922.01, with the 25-day and 99-day moving averages at $878.79 and $766.32, respectively. This configuration reflects ongoing upward momentum and a robust long-term trend. The daily amplitude of 4.22% highlights active participation, while the market capitalization climbed to $133.1 billion, reinforcing strong liquidity.

BNBUSD Chart | Source:x

The chart also shows a sustained advance from a major support near $601.25, demonstrating months of accumulation. Analysts from PRIME 𝕏 observed that buying pressure has remained firm during pullbacks, with BNB repeatedly holding above critical support ranges. These conditions support the view that the token’s uptrend remains intact, with key price floors well established.

Analyst Outlook for the $1,000 Mark

Market strategist, Rand, reaffirmed a positive medium-term outlook. Rand stated on X that a move to $1,000 is “programmed” and “can’t be stopped,” citing persistent buying interest and an earlier breakout above $820 and $860 on the three-day chart. The price has since held near $940, indicating that buyers continue to dominate trading sessions.

BNBUSDT Chart | Source:x

Technical observations support this perspective. Breakout levels around $780 and $860 now function as support, reducing the likelihood of sharp corrections. Multiple retests of these price zones have confirmed their strength, with rising trading volume offering further evidence of sustained market confidence. The next key area of resistance sits at $1,000, a psychological barrier that traders are closely monitoring.

Market Participation and Volume Growth

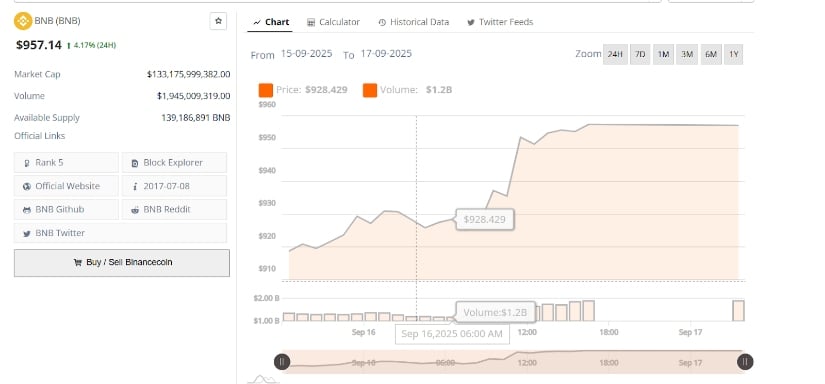

Over the past 24 hours, the asset rose to $957.14, representing a 4.17% increase. Trading volume approached $1.95 billion, reflecting strong investor activity. Market analysts link this growth to institutional engagement and increased on-chain transactions, which together indicate healthy market depth.

BNBUSD 24-Hr Chart | Source: BraveNewCoin

The price pattern reveals a steady climb through $920 and $940 before testing $955. This gradual movement, followed by a late-day surge, points to orderly market behavior rather than speculative spikes. Analysts regard the $930–$940 zone as immediate support, with the potential for the market to build a base here before attempting a sustained push toward $1,000.

Key Levels and Long-Term Trend

Binance’s ability to maintain prices above its key moving averages strengthens the long-term positive structure. The 7-day, 25-day, and 99-day moving averages continue to slope upward, a configuration that often signals a steady uptrend. Analysts emphasize that holding above the $900–$920 area will be essential for confirming the next upward phase.

Should it achieve and maintain a close above $1,000, market observers expect new record highs to follow. The combination of high trading volume, robust support levels, and consistent institutional demand creates conditions conducive to further price discovery. As of now, Binance remains one of the most actively traded large-cap digital assets, with market participants watching closely for confirmation of its next breakout.

2 hours ago

2

2 hours ago

2

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·