TLDR

Avalanche (AVAX) DEX trading volume hit $31 billion in September 2025, the highest weekly volume of $4.2 billion in three years Network transactions jumped 201% in 30 days to nearly 50 million, with active addresses rising 22% to 753,455 users Avalanche became the fourth-largest blockchain for real-world asset tokenization with $726 million total value locked AgriFORCE Growing Systems plans to raise $550 million for AVAX tokens through the AVAX One project backed by Anthony Scaramucci Technical analysis shows potential surge to $50 target after forming double-bottom pattern and breaking above $27 resistanceAvalanche has posted record-breaking numbers across multiple metrics in September 2025. The blockchain network achieved $31 billion in decentralized exchange trading volume for the month.

🚨 BIG: $AVAX saw $31B in DEX Volume in September. pic.twitter.com/z7YjGOacdi

— Marc Shawn Brown (@MarcShawnBrown) September 27, 2025

This trading milestone comes alongside a 201% surge in network transactions over the past 30 days. The network now processes nearly 50 million transactions, making it one of the fastest-growing blockchains in the space.

Active addresses on Avalanche increased by 22% to reach 753,455 users. This growth in user adoption directly correlates with the increased trading activity across the platform.

Weekly DEX trading volumes reached $4.2 billion, marking the highest level in three years. The consistent high volume indicates sustained interest from both retail and institutional traders.

Despite the strong network fundamentals, AVAX price traded at $27.72 in late September, showing an 18% decline over the previous week. Market analysts attribute this to weak support levels and low liquidity conditions.

Real-World Asset Growth Drives Adoption

Avalanche has emerged as the fourth-largest blockchain for real-world asset tokenization. The network’s total value locked in the RWA sector reached $726 million, representing a 50% increase.

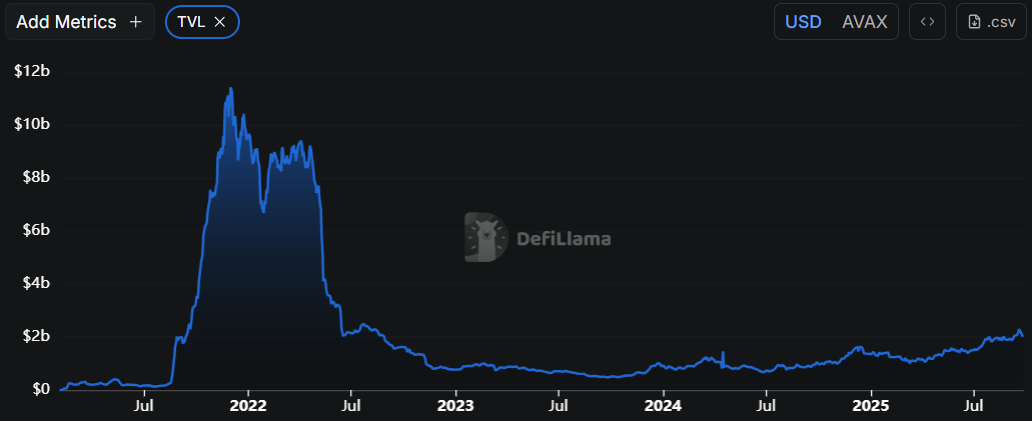

Source: DefiLlama

Source: DefiLlama

This positions Avalanche behind only Ethereum, ZkSync, and Polygon in the tokenization space. The growth reflects increasing institutional confidence in the platform’s capabilities.

Anthony Scaramucci’s Skybridge Capital announced plans to bring over $300 million in assets to the Avalanche network. The move represents a major institutional endorsement of the platform.

Mirae Capital Management, which manages over $316 billion in assets, recently partnered with Avalanche. This partnership expands the network’s reach into traditional finance sectors.

AgriFORCE Growing Systems, transitioning from agriculture technology to crypto, plans to raise $550 million for AVAX tokens. The AVAX One project has backing from Anthony Scaramucci and Hivemind Capital.

The project aims to tokenize traditional assets on the Avalanche blockchain. This institutional involvement could increase network adoption and trading volumes.

Technical Analysis Points to Potential Rally

Chart analysis reveals a double-bottom pattern formation at $15.84 with a neckline at $27. This technical setup typically precedes strong bullish breakouts in crypto markets.

Source: TradingView

Source: TradingView

AVAX successfully broke above the $27 neckline on September 9. The price later retested this level, confirming the bullish breakout pattern according to technical traders.

The cryptocurrency remains above its 100-day Exponential Moving Average, indicating bullish momentum. Technical analysts view this as a positive signal for continued upward movement.

Price targets based on the double-bottom pattern point to $50 as the next resistance level. This represents an 82% increase from current trading levels.

However, a drop below the key support at $20 would invalidate the bullish technical forecast. Traders are monitoring this level closely for any breakdown signals.

The Securities and Exchange Commission is considering several spot AVAX exchange-traded fund applications. ETF approval could provide additional price catalysts for the token.

Companies have begun accumulating AVAX tokens for their corporate treasuries. This institutional buying could provide price support during market downturns.

The network’s growing role in decentralized finance and NFT sectors continues to drive fundamental demand. These use cases provide utility beyond speculative trading activity.

Current network metrics show sustained growth in both user adoption and transaction volume, supporting the technical analysis outlook for higher prices.

The post Avalanche (AVAX) Price: Could Record $31 Billion Trading Volume Drive AVAX to $50? appeared first on CoinCentral.

1 hour ago

3

1 hour ago

3

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·