The Curve Finance decentralized autonomous organization (DAO) is currently reviewing a proposal that could unlock new revenue streams for the platform and its broader ecosystem.

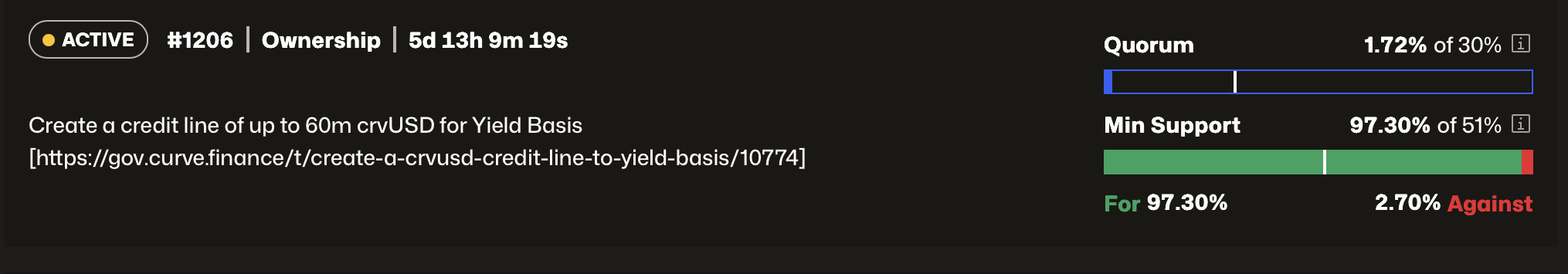

The proposal, initially introduced in August by Curve founder Michael Egorov, aims to establish a $60 million credit line of crvUSD for Yield Basis. As of now, approximately 97% of votes favor the proposal, indicating strong support within the community.

Under the Yield Basis scheme, users who stake their CRV tokens will receive veCRV (vote-escrowed CRV) in return, effectively creating an income-generating mechanism for stakers. The plan is to distribute between 35% and 65% of Yield Basis’s value back to veCRV holders, while reserving an additional 25% for ecosystem development and sustainability.

Current voting for the $60 million credit line proposal. Source: Curve Finance

Current voting for the $60 million credit line proposal. Source: Curve Finance

According to Egorov, the proposed credit line would support the development of liquidity pools for assets such as WBTC, cbBTC, and tBTC.

“The goal is to incentivize the Curve ecosystem and to provide a fee for utilizing Curve technology (cryptopools), which power the platform’s core,” Egorov explained in the proposal. He added that 25% of Yield Basis liquidity provider earnings would be allocated to Curve.

Yield Basis aims to address the challenge of impermanent loss—a common issue in DeFi where liquidity providers may suffer losses due to asset rebalancing—by borrowing and creating a supply sink simultaneously. This approach allows Total Value Locked (TVL) and debt in Yield Basis to expand without undermining the peg of crvUSD.

Impermanent loss occurs when assets deposited in a liquidity pool fluctuate in value, potentially leading to losses compared to holding assets outside the pool. It has been a concern for many DeFi protocols and liquidity providers.

Currently, Curve Finance maintains a TVL of approximately $2.4 billion, according to data from DeFi Llama. This is a significant decline from its peak of over $24 billion in January 2022, reflecting the challenges faced amid increased security issues and market volatility in the crypto markets.

Additionally, Curve has faced setbacks from DNS attacks and scams, highlighting ongoing security vulnerabilities in crypto protocols.

Related: Curve founder repays 93% of $10M bad debt stemming from liquidation

DeFi Gains Momentum in 2025

The decentralized finance sector has been experiencing renewed growth in 2025 after a prolonged slowdown. As of Thursday, the total value locked (TVL) across all DeFi protocols rose to $163.2 billion, up from $115.8 billion at the start of the year—a growth of nearly 41% in less than nine months.

Protocols like Aave, which now boasts a TVL of $42.5 billion, continue to expand. In August, Aave launched on the Aptos blockchain, an emerging platform with lesser competition in DeFi, and is preparing a new version set to launch soon.

Meanwhile, Ethena has gained traction, with its synthetic stablecoin crossing $500 million in revenue following the passage of the GENIUS Act in the US, underscoring the sector’s increasing mainstream relevance.

This article was originally published as $60M Proposal to Grow Business and Boost User Income on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

1 hour ago

1

1 hour ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·